With slightly over 155,000 registrations the French passenger car market started the new year with a minor loss of 1.1%. While the Private Market missed its volume from last year’s January by less than 300 registrations (- 0.3%) the fleet market was down by 2.5%. However, this result is far from being disastrous, as it was less of a volume loss than seen in the last four months. Also, worth noting is that January 2018 was the best first month of a year ever for the French True Fleets and therefore a tough challenge given the current climate. For Special Channels we saw a mixed picture with a growth of 13.0% for Dealerships/Manufacturer registrations and a reduction of the Short-Term Rental volume by remarkable 22.7%.

Brand performance

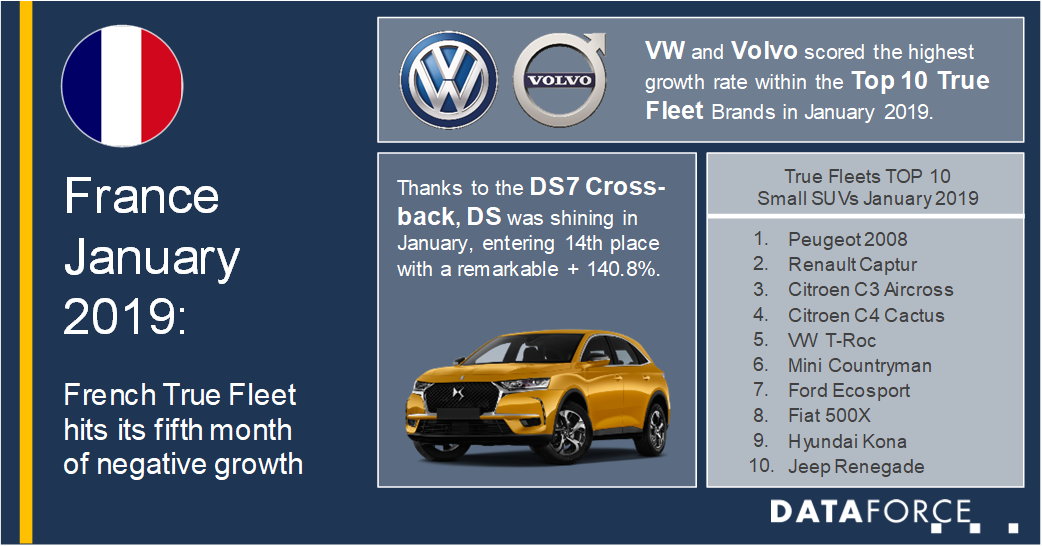

The two market leaders Peugeot and Renault kept their positions but suffered a decline of – 8.5% and – 13.8% respectively. Citroen (+ 11.9%) kept rank number three with its highest market share since July 2017. Volkswagen stayed on rank number four but scored an impressive + 38.7%. The biggest push within the German manufacturers model ranks came from Polo and the new T-Roc which was positioned fifth in the SUV Small segment and was the best non-French model.

BMW in fifth place achieved a double-digit growth of 12.9% and gained one position as well as Toyota (6th, + 2.1%), Audi (7th, – 5.4%) and Mercedes (8th, + 2.3%), while Ford dropped back into ninth position. Ford’s registrations almost collapsed with a minus of 36.4% over January 2018. Volvo completed the top ten with a remarkable + 21.6%.

Thanks to the DS7 Crossback, DS more than doubled its registrations and jumped from rank 17th into 14th. While the Peugeot 5008 is dominating the Medium SUV class the DS7 is already number two. A bit further down the ranking we saw a very good performance from a Korean manufacturer: thanks to the Kona, with additional support from the Tucson, i20 and i30, Hyundai achieved its best market share in True Fleets since November 2015.

Small SUV performance

The Hyundai Kona mentioned above was only one out of several Small SUV with a huge improvement in January. No less than 13 out of the top 15 models in the segment increased their volume compared to January 2018; six of them even by a three-digit percentage. Overall there was no other vehicle class with a higher growth by absolute figures. The segment was up by + 39.3% and with a share of 10.4% it achieved a new record in the French fleet market.

Fuel type performance

January showed extraordinary results in terms of fuel type shares. While the Diesel fell to a new low point with 61.8%, the one for company cars equipped with a petrol powertrain peaked out with 31.0%. Meanwhile Alternative fuel types only achieved a small improvement compared to the average share for 2018. And although Private customers and company car drivers are pretty different target groups in many perspectives, this (fuel type) trend is identical and we had an all-time high for Petrol and an all-time low for Diesel in the Private Market for January as well.