Can the European car market recover in 2022? How will electrification continue, and which trends will determine market dynamics? Find the Dataforce forecast and assessments of our market experts here.

European passenger car market forecast

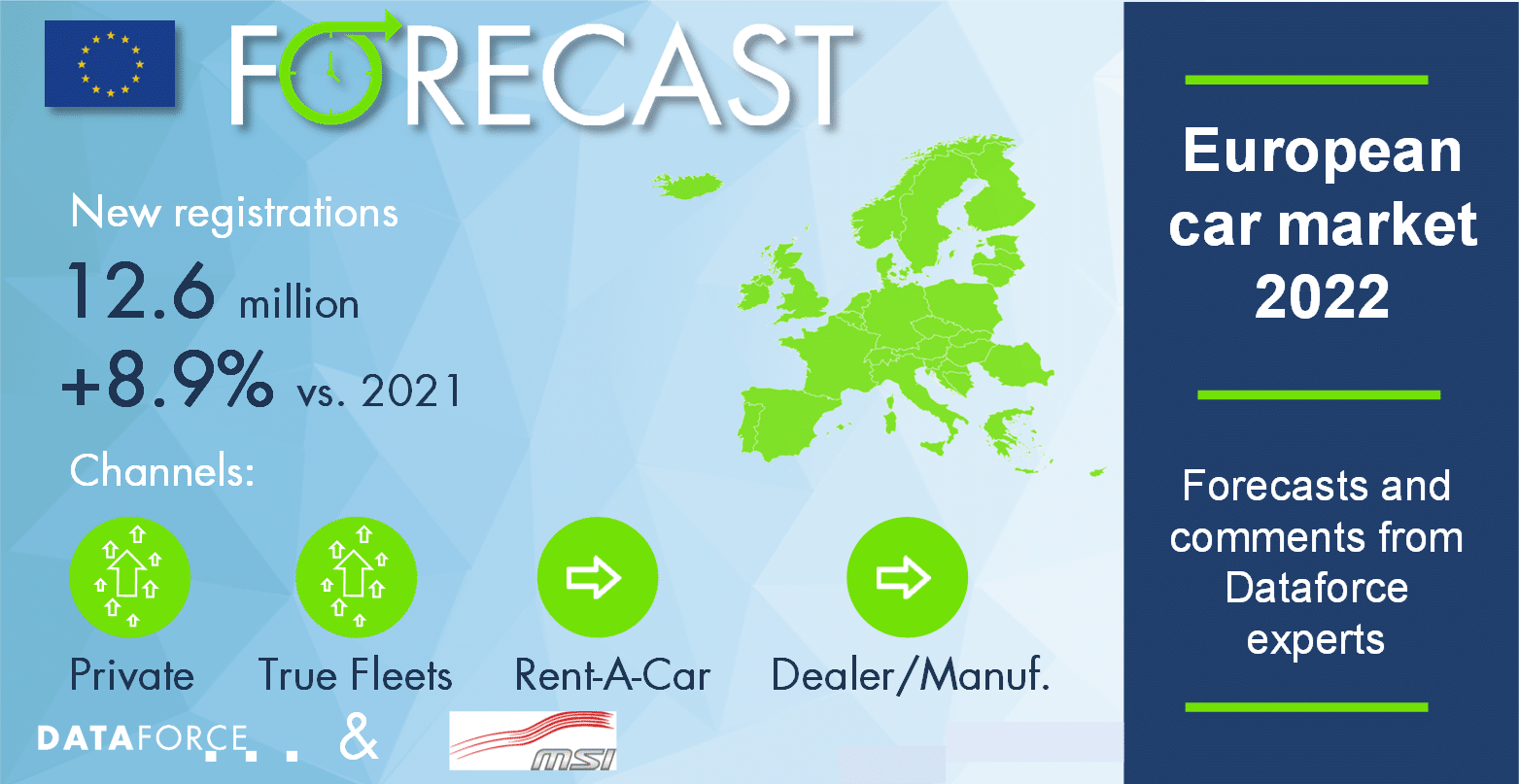

A slight increase in vehicle production in the first half of the year and stronger growth in the second half will lead to around 12.6 million new registrations in Europe[1] in 2022. Compared to 2021, this is an increase of 8.9%. The private market will develop somewhat more strongly than commercial new registrations. Here, we expect substantial growth in company cars, but rental companies, manufacturers and dealer activity will still be limited by supply shortages.

Fuel type development

Electric vehicles will continue to expand their market share next year. However, the pace of growth is slowing down. We expect BEVs, PHEVs and HEVs combined to increase their market share by only 3.5 percentage points. The easing of semiconductor shortages imply that manufacturers have more capacities to produce petrol and diesel vehicles again, and as EV shares continue to rise, they also need to worry less about their CO2 targets.

At the same time, it is becoming increasingly difficult to attract additional customers. In the premium segment, many buyers already drive electric. For small and compact cars, however, the price premium for BEVs is still relatively high and the ranges are shorter while some countries are reducing their EV subsidies.

Comments