So there is no getting around it despite the automotive industry struggling thorough the pandemic, 2020 was a positive year for EVs but has that continued at the same pace in 2021? Has the demand ebbed away or are consumers being drawn back to the fossil fuel counterparts?

Apples vs Apples and not pears

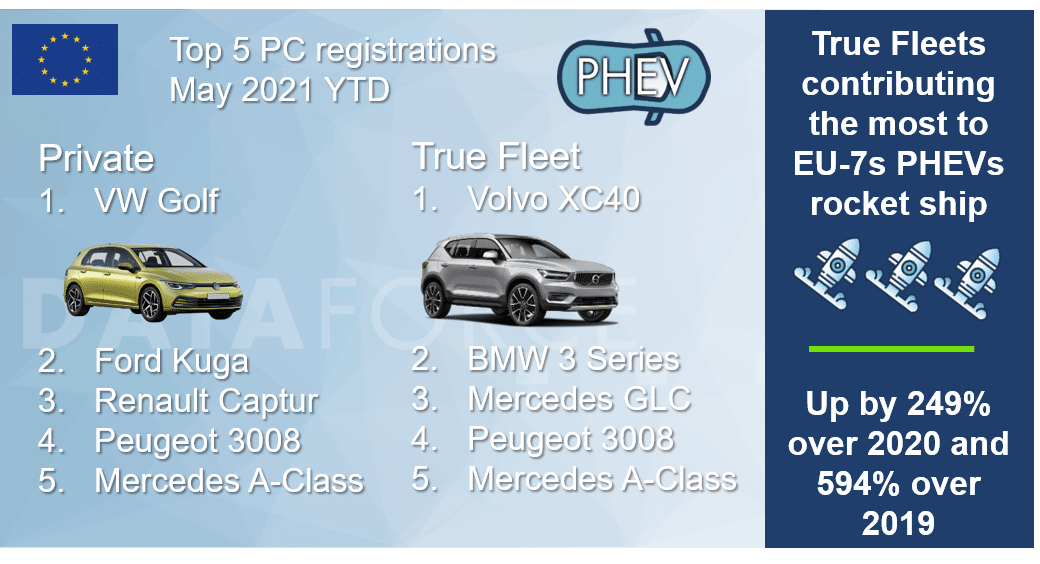

We can see the markets of the EU7 in recovery mode with almost all countries and the corresponding market segments showing positives over 2020, not a surprise given the multiple problems that came as a result of the pandemic. For this reason, we will also include some comparisons with 2019 in order to give a better overall understanding. As a quick overall view, we see EU-7 countries showing a 33.2% increase over 2020 figures May year-to-date. True Fleet leads the recovery charge up 40.2%, with the welcome sight of RAC following with 2nd highest recovery percentage, up by 35.9%. Private then follows before the Dealer and Manufacturer channel. In comparison to 2019 figures True Fleet is again fairing best down by only 12.6% while the Private market is down by 28%.

More plugging-in and less plugging up

One thing that came as a result of the lockdowns and work from home policies has been less cars on the road (especially during rush-hours) but that seemingly has not stopped the PHEVs or Electric cars from capitalizing and registering over 580,000 cars so far this year. For the 2021 vs 2020 comparison the EU7 countries show an increase of 262.8% for PHEVs and 128.8% for Electric cars and when we look at 2019 a staggering + 641.1% and 250% respectively. Worth noting here is that it has been mostly the Private market driving Electric volume while for PHEV it has been True Fleets. Petrol and Diesel are also showing increases for the 2021 vs 2020, though much more muted with a 23.8% and 8.0% respectively. However, compared with 2019 both show big drops, -35.4% for Petrol and -44.3% for Diesel equating to almost 2,000,000 less registrations in total.