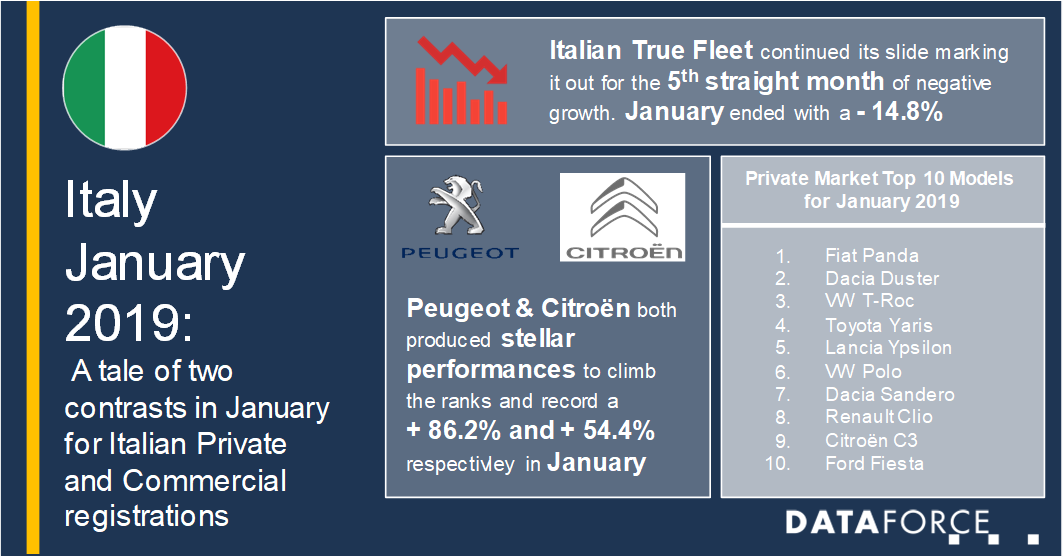

Italy’s True Fleet contraction continues with the 5th month of negative growth recorded. From the EU-5 countries only Spain (December’s +4.7%) and Germany (January’s +7.6%) have been able to break out of the True Fleet registration slide since the WLTP introduction in September 2018. However, the Private Market continues to bring a ray of sunshine, in positive numbers, to Italian new car registrations. Up by 6.2% in January it is worth noting that this is now the 4th consecutive month of growth and apart from September’s negative has been seemingly untouched by the WLTP turmoil. Now for the Commercial/Business registrations, True Fleets were down by a hefty 14.8% and Special Channels by a staggering 29.4% with the Dealership/Manufacturer sub-channel carrying the most weight with a little over 10,000 registrations less than in January 2018!

Brand performance

There were two big winners in fleet’s brand performance ranking and perhaps no surprise in the fact both of these were well prepared and had no delay when it came to WLTP homologations. Number 1 spot on the ladder went to the seemingly immovable Fiat but it was worth noting that in January 2018 they outperformed the next nearest rival by 3,846 (Ford) where as this month that gap was only 2,487 registration (VW). 3rd place went to the first of the big winners and it was Peugeot moving from 10th with a stellar + 86.2%. This result came mostly from the 3008 and 308, but the 2008 and 208 pitched in as well. They were followed by BMW, Audi, Jeep, Mercedes, Ford and Renault in that order leaving our last big winner for January in 10th and it was another French manufacturer. Citroën put on an impressive display moving up 5 places with a + 54.4%. Their leading models (like Peugeot) were also the three’s, the C3 and C3 Aircross with a little help from the C4 Cactus. Outside the top 10 we also saw some steady gains from Volvo in 16th with a + 26.9% and Seat in 20th with a + 79.9%.

Purchase Power

As one of our analytical dimensions we have the ability to calculate the purchase power of fleets which refers to the number of cars which have been registered to a company over the last 12 months. For January for example the fleets with a Purchase Power (PP) of 1-9 cars made up around 14.3% of the market share however this was down from a 22.2% share in January 2018. The top 3 models of Jeep Compass, Fiat Panda and Mercedes GLC all followed the market with a decline but in 4th the Range Rover Sport boasted a healthy 47.1% increase and in 6th the Mercedes A-Class also saw an increase of 44.3%. It is also worth noting that Diesel remains the strongest fuel type and currently makes up 65.5% of all the new registrations within the 1-9 PP grouping.