With fuel types choices moving more and more into the focus of the (fleet) market, Dataforce has implemented a comprehensive overhaul of our registration data, now showing Hybrid vehicles without the Mild-Hybrid (MHEV) concept. Considering MHEVs as Petrol and Diesel engines rather than as Alternative fuel type allows to track the market penetration of full and Plug-In Hybrid more precisely, avoids indicating an unrealistically high Hybrid share and makes fuel type shares comparable between countries treating MHEVs differently.

Why Mild-Hybrid is not Hybrid

Ok, so let’s get a little technical: Pressured by continuously tightening CO2 targets, manufacturers and suppliers are working intensively on new technologies to improve fuel economy. One of these are Start-Stop Systems that have been spread broadly throughout the previous decade and can now be found in most new cars sold in Europe. These systems consist of an additional battery, a recuperation system and an electric starter motor.

Mild Hybrid is in many cases just extending this concept a little further, particularly when looking at the 48 Volt belt starter generator as the most popular implementation. The pivotal distinction against full hybrids is that the electric motor lacks the power to propel the car without the thermal engine, not to speak of the tiny battery and other limitations. Without an EV-Mode MHEVs are basically Start-Stop engines that allow earlier and more frequent engine stops. Some implementations are additionally providing a limited boost from the electric motor that allows the combustion engine to run more economically, though overall fuel savings are usually in the range of 5%.

Introducing a standardised definition for Hybrid vehicles

Under the absence of a European standard for Hybrid fuel types, registration authorities have developed their own definitions. In France, Italy, Germany or Norway most cars with an electric motor are considered Hybrid regardless of its power and capabilities, while countries such as Belgium, Finland or Sweden treat MHEVs as Petrol or Diesel in their statistics with some other countries somewhere in between.

Furthermore, OEMs are adapting MHEV technology quite rapidly. At the end of 2019, a third of all available models could well be offered with an MHEV option. Counting these as (full) Hybrids may result in the doubling or tripling of this fuel type’s share, that would then no longer reflect the real choices and preferences car buyers are taking.

Consequently, Dataforce sees only those cars that have an electric motor powerful enough to propel the vehicle without the thermal engine as full Hybrids (HEV). That is regardless the technical implementation which can be belt-starter generator, crankshaft, clutch or something else.

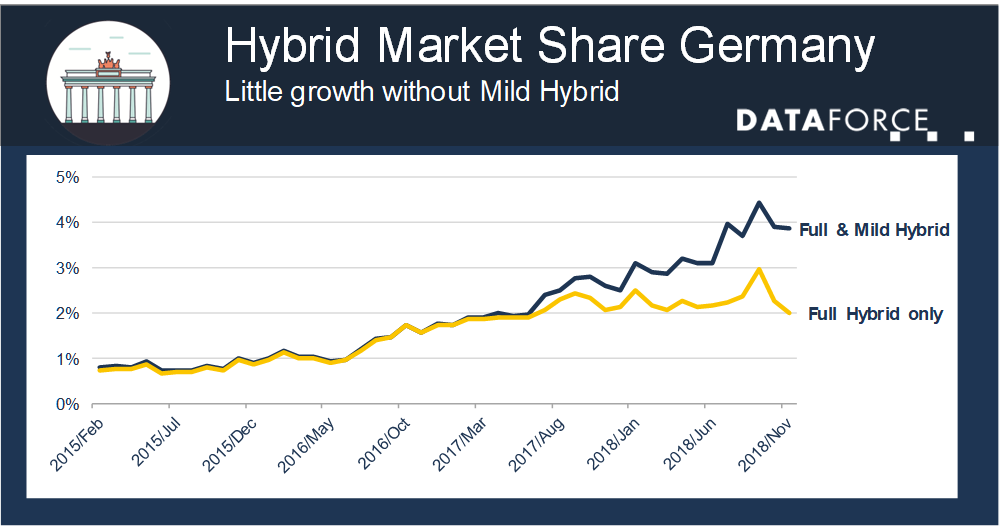

Numbers please: Showcase Germany

With MHEV counted as Hybrid in Germany and the local brands Audi and Mercedes already offering a broad range of models with this technology, Germany already has a significant penetration of MHEVs. When referring to local statistics, less than 10% of the Audi A8 2018 YTD November new registrations are Petrol or Diesel while 90% are coming as Hybrid. With Dataforce’s separation of MHEVs, we see a 30.2% share for Petrol (down by almost 15 percentage points against 2017), a 68.3% share of Diesel (up 14 %-pts.) and a few Plug-In Hybrids.

On Total Market scale, the Hybrid share appears to have leapfrogged from 2.4% in 2017 toward 3.7% in 2018 (YTD November). However, taking out the MHEVS results in a significant slowdown of the Hybrid growth. Extending its share from 2.2% to a mere 2.4% is likely below expectations for the development of this fueltype, particularly in the light of the diesel crisis.