The negative trend in Switzerland has continued. In August, the Private Market suffered the sharpest decline year to date. Commercial registrations also declined, with the fleet market bearing the main burden for this development.

Passenger car market in August 2019

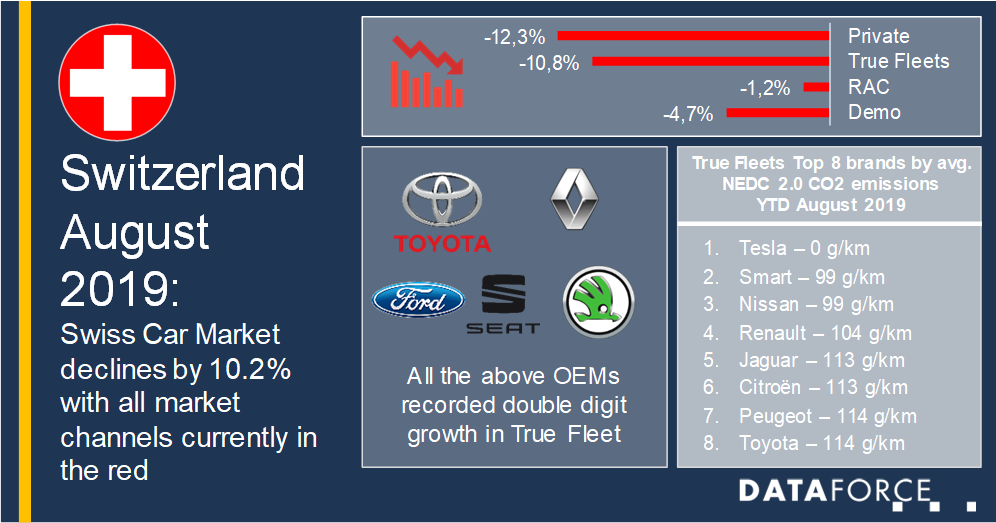

Just below 19,300 passenger cars were registered, which represent a decline in the total market of 10.2% when compared to the same month last year. All market channels were in the red. The Private Market was particularly affected with – 12.3%, while the True Fleet Market was down by – 10.8%. This decline also spilled over into the tactical channels with registrations of Short-Term Rental companies falling by 1.2%, as did the registrations from Dealer & Manufacturer contracting by 4.7%. This leaves the Total Market down 1.5%.

More winners than losers among top 10 fleet brands in August

Among others, the month of August was more encouraging in terms of fleet registrations for Toyota (+ 70.5%), which aroused the interest of corporate customers and in particular with the Yaris, RAV4 and Corolla Touring Sports models. Renault also recorded growth of 51.2%, thanks to the steep increase in the number of new registrations for the Megane. In addition, Ford (+ 24.2%), SEAT (+ 20.8%) and Skoda (+ 18.9%) were the other OEMs from among the top 10 fleet brands to record double-digit growths in August.

Why did the True Fleet market nevertheless close the month with a double-digit decrease? To some extent it was the premium brands which suffered the losses. Audi, BMW and Mercedes’ registrations fell by 18.7%, 7.0% and 5.3% respectively. However, the most beleaguered brand was VW, dropping by 46.2%. In order to put thus into context, it should be mentioned that VW delivered a large number of vehicles to companies in the same month last year, pre-empting the first implementation of the WLTP emission standard and any possible issues homologating new vehicles.

Light commercial vehicles with further growth – fleet market in the red

Registrations of light commercial vehicles up to 3.5t rose by 1.6% year-on-year. Both the Private Market (+ 1.5%) and commercial registrations (+ 1.7%) recorded growth.

However, a look at the detailed commercial channels split shows a dip of 6.1% for the True Fleet Market in August, though from YTD perspective 4.7% more vehicles were registered. The tactical channels, i.e. Short-Term Rentals (+ 45.5%) and Dealer & Manufacturer (+ 52.6%) were responsible for the growth in commercial registrations in August. Coming back to the fleet market, within the top 10 brands only 3 improved year-on-year: Peugeot (+ 24.1%), Fiat (+ 21.3%) and Renault (+ 17.7%).