True Fleets with another positive performance

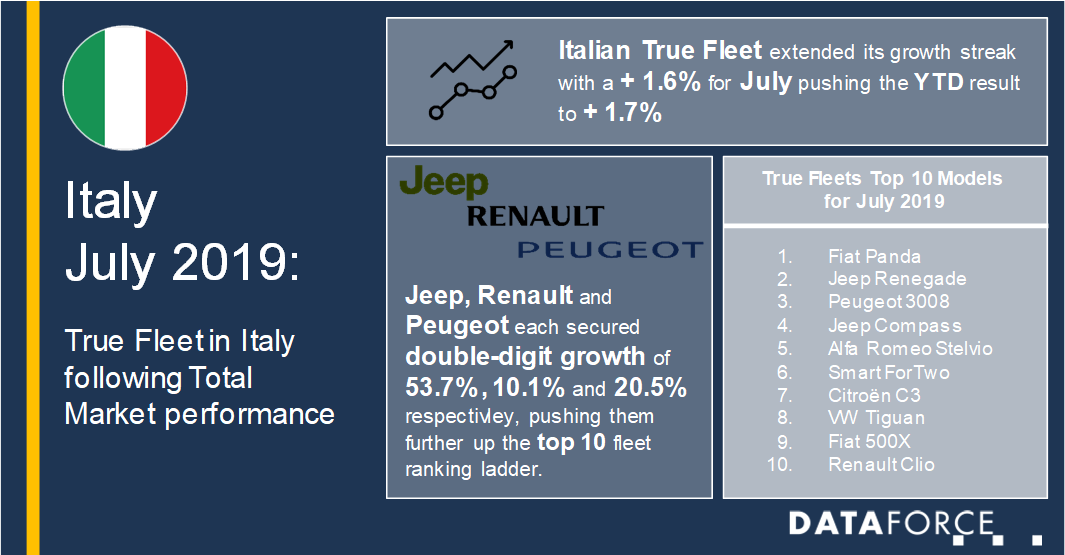

Thanks to a strong previous three months for True Fleets the market is now back to a positive standing with July’s + 1.6% just pushing the year-to-date to + 1.7%. Overall Total Market registrations stand at just below 169,000 or + 1.4% for July and RAC also showed an increase of 5.3%. This left the Dealer/Manufacturer channel to bring the downward pressure to the average (- 25.0%), which depending on your view (of this tactical channel) may not be a bad thing.

Brand rankings showing some hefty movement

We are seeing quite some movement in terms of brands ranking within True Fleets, not only in the month of July but also from a YTD perspective. While the top three remain secure in their places at present, Fiat 1st, VW 2nd and Audi 3rd for July and YTD, this comes despite a significant drop from the home brand of 10.3% YTD. Though worth mentioning is that in terms of volume VW would still need to almost double their registrations to catch them.

In July: Jeep (4th), Renault (5th) and Peugeot (6th) each managed double digit growth rates with them moving up from 11th, 7th, 12th respectively. Mercedes, BMW and Ford followed and though each had a negative month BMW did manage to retain their place in 8th. Opel were 10th in the ranking and achieved a four-place jump thanks to a growth rate of 117.0% and while Citroën did not manage top 10 place, they also achieved triple digit growth (+ 118.5%) and jump four places.

YTD: From a YTD perspective it really seems to be the French brands (or owned by one) that are pushing for further market share, Renault in 4th are up from 8th thanks to a 39.4% uptick, Peugeot in 6th have climbed from 10th thanks to a 38.2% surge and Opel appear to also be managing a resurgence, up by 66.0% and are once again top 10 (10th place). Hardest hit in percentage contraction have been Ford and BMW with the former dropping six places into 9th and the latter two places into 8th.

French brands model uplifts

So exactly what models are helping the French brands push deeper into the Italian market place for 2019 YTD?

Renault – the models Captur and Zoe are each managing triple-digit growth with the Zoe a mere 34 registrations away from overtaking the Megane. In terms of volume uplift (as well as volume absolute) it’s the Clio that carries the major share.

Peugeot – it’s the 2008 and new 508 which are achieving the highest percentage volume growth, but it really is the 3008 and 308 that are generating the volume uplift. Combined these two models have manged an extra 3,200 registrations between them for the OEM or in the region of 80% of the total uplift for Peugeot in 2019.

Citroën – for the 11th placed OEM the C3 and its SUV twin the C3 Aircross take the crown for both volume growth percentage and absolute volume uplift but the new comer in the C5 Aircross has also brought some significant volume helping Citroën to its 63.0% increase for 2019 so far.