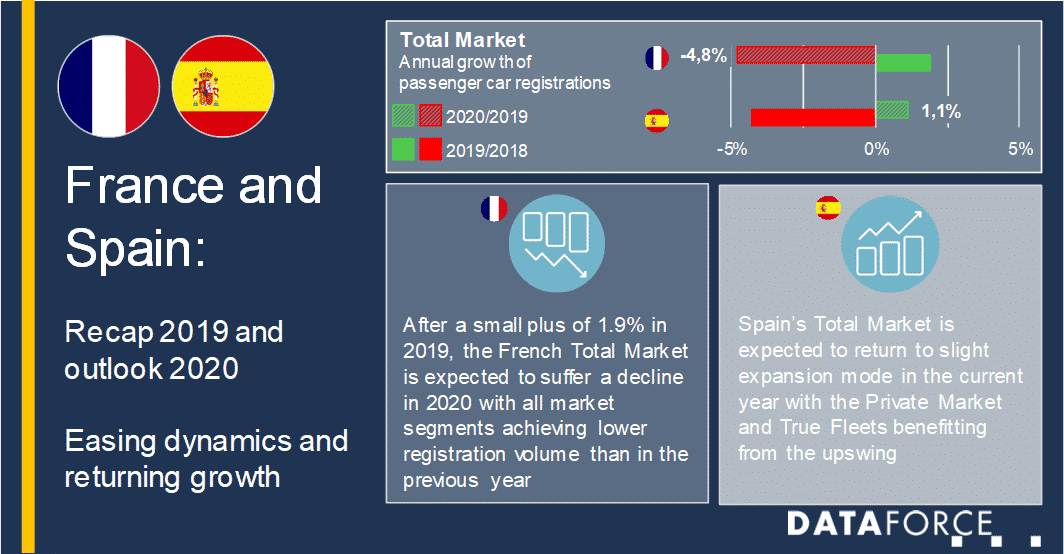

Several markets and market segments performed better than expected in 2019, as seen in French and Spanish True Fleets. For 2020, the growth in registration volume is expected to lose some of its momentum. Nonetheless, Dataforce also identified a few highlights for the current year.

In the shadow of the German passenger car market’s outstanding performance, other European countries also managed to achieve some remarkable results in 2019. In France for example, Total Market registrations were able to surpass the threshold of 2.2 million car registrations (+ 1.9%) representing the third best annual result in Dataforce statistics starting in 2003. Furthermore, a very good year for Spanish True Fleets (+ 6.0%) prevented the Total Market from declining even further (- 4.3%).

Best values for True Fleets

The result of the French market was heavily driven by True Fleets, which achieved a new record value, standing at almost 534,000 registrations by the end of 2019 (+ 13.6%). Furthermore, self-registrations of dealerships and manufacturers increased by a double-digit rate of 13.2% compensating for the drop of demand from private drivers (- 6.7%).

In Spain however, Total Market stood at a minus of 4.3% in 2019. Like in France, the Private Market saw its registration figures decline (- 10.6%) with the tactical Special Channels also following this trend. Only the True Fleet Market with its plus of 6.0% improved significantly in 2019, representing the sixth consecutive annual increase of fleet registrations and also the highest volume since Dataforce was able to identify True Fleet registrations in 2008. It is noteworthy, that mainly the Leasing and Long-Term Renting sub-segment was responsible for this growth (+ 13.7%) while the purchased company cars even declined slightly (- 2.8%).

Cloudy outlook for France

Although economic sentiments were driven down by internal political difficulties resulting in protests against the government and the slowing of global economy, which was also influenced by trade conflicts, French companies were resilient and continued to invest into their fleet parc. With the negative surroundings likely persisting in 2020, the sentiment’s downturn will spill over to a larger extent than in the prior year, which will then reduce the willingness to invest.

Further troubling factors are the adjustments of the Bonus-Malus system leading to frictions in the monthly registration volumes. The boundaries were already tightened in January with the malus starting at 110g CO2 /km (EUR 50). Penalties even reach EUR 20,000 for cars emitting more than 184g CO2 /km, which is a significant raise compared to the maximum malus of EUR 10,500 in 2019. Furthermore, the Bonus-Malus system will undergo another change with the calculation base switching from NEDC 2.0 to WLTP in March. Therefore, boundaries will be adjusted adequately with penalties starting from 138g CO2 /km and the maximum malus coming into effect at 212g CO2 /km. Therefore, car buyers will try to bring their registration forward into the first months of 2020 or have already done so during the last months of 2019, leaving negative repercussion effects slowing down registration growth for the current year. Therefore, Dataforce expects the Total Market to fall short of 2019’s numbers by 4.8% with True Fleets facing a large decline of registrations (- 13.5%).

Spain expected to be back on growth track

Regarding 2020, the Total Market might return to its expansion mode. The economic outlook is still promising although companies and private households might postpone investment spending and big-ticket purchases in a slowing eurozone environment.

Nonetheless, traffic restrictions e.g. in Barcelona effect a growing mass of drivers, who might be pushed towards a renewal of their car. Furthermore, the registration tax in Spain will undergo a major change as well with the underlying calculation base switching from correlated NEDC to WLTP in 2021.

Combined with the robust income growth of individuals over the prior years, the change in taxation will lead to anticipatory purchases in the last months of 2020 as car buyers scramble to benefit from the more favourable tax scheme. Therefore, Dataforce expects Spain’s Total Market to grow slightly by 1.1% in 2020 with the Private Market (+ 6.4%) and True Fleets (+ 4.9%) being responsible for this increase with Leasing & Long-Term Renting continuing to attract a growing number of customers.