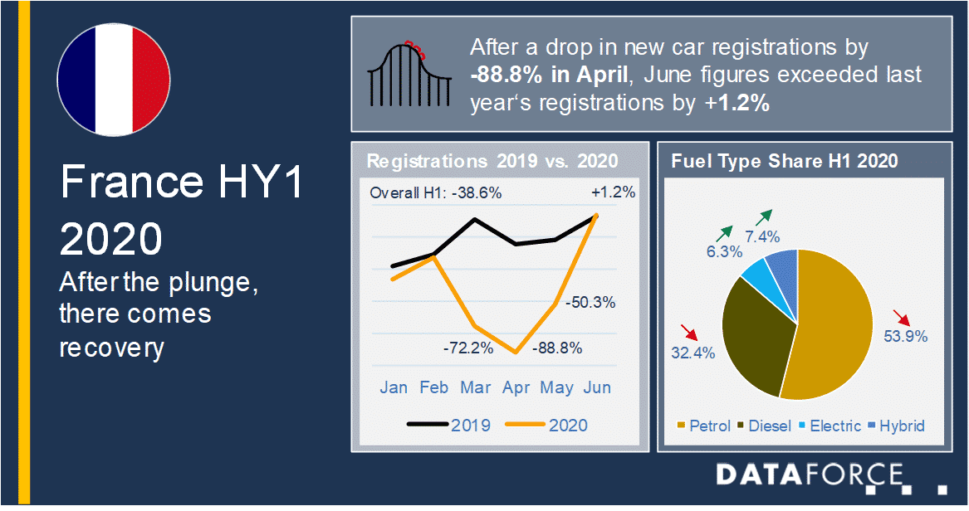

The first half year in France was dominated by Covid-19 and government incentives to support the automotive industry. After dealership closures on 17 March, new car registrations slumped by 88.8% in April.

In May, Emmanuel Macron announced a ‘plan to support the automotive industry’ which led to a rapid recovery, with registrations in June even exceeding the previous year’s figures. Regarding the fuel type mix, a strong increase in registrations of alternative drives can be observed. With market shares at 6.3% for BEVs (compared to 1.8% in 2019) and 7.3% for hybrids (4.1% in 2019), the governmental incentives for buying electrified vehicles appear to be working well.

Italy: RAC Segment hit very hard in first half of 2020

By Salvatore Saladino – Country Manager (salvatore.saladino@dataforce.it)

During the first half year in Italy, new car registration fell by 47.9% compared to the same period in 2019. Most affected by the virus was the RAC segment: With a fall of 97.1% in March and 99.7% in April compared to the year before, there were almost no new registrations. This decrease continued in May with 92.4%. Car rental companies in Italy did obviously not expect tourists this year. But in June, we can already see an increasing number of car registrations in the Rent-A-Car segment.

True Fleets market registered 127,444 cars against 223,621 of the same period in 2019, with a 43.0% fall. Still, there are no measures to reduce company car taxation to the other EU countries’ level.

Spain: True Fleets in Spain on the way to recovery

By Michael Gergen – Automotive Data Specialist (michael.gergen@dataforce.de)

In the first half year of 2020, Spain was also hit by the corona virus. After a good start in January and February, the virus hit Spain in March were new car registrations fell by 69,5%. Following a disastrous April and a still horrible May new car registrations in June were down by “only” -36.1%.

But, the analysis by market segment reveals a positive aspect in June 2020: while the volume on Rent-A-Car companies and especially manufacturer & dealerships decreased by 76.0% and 48.2% respectively, the drop for registrations on private households was much smaller with -11.4%.

True Fleets declined by 18.2% in June which reduced the total loss for the first half year to 38.2% which is clearly better as the other major market channels. With these figures there is a light at the end of the tunnel for the end of H1 2020.