The German car market took a severe hit in September, as did most of Europe, thanks to the missing registrations of vehicles with no WLTP (Worldwide Harmonised Light Vehicle Test Procedure) homologation. Total Market new registrations tumbled by 30.5%. In order to find a weaker September result in absolute figres (200,134 for September 2018), we had to make a trip into our dusty archives and eventually discovered statistics for the same month in 1985 as the first year with less September registrations.

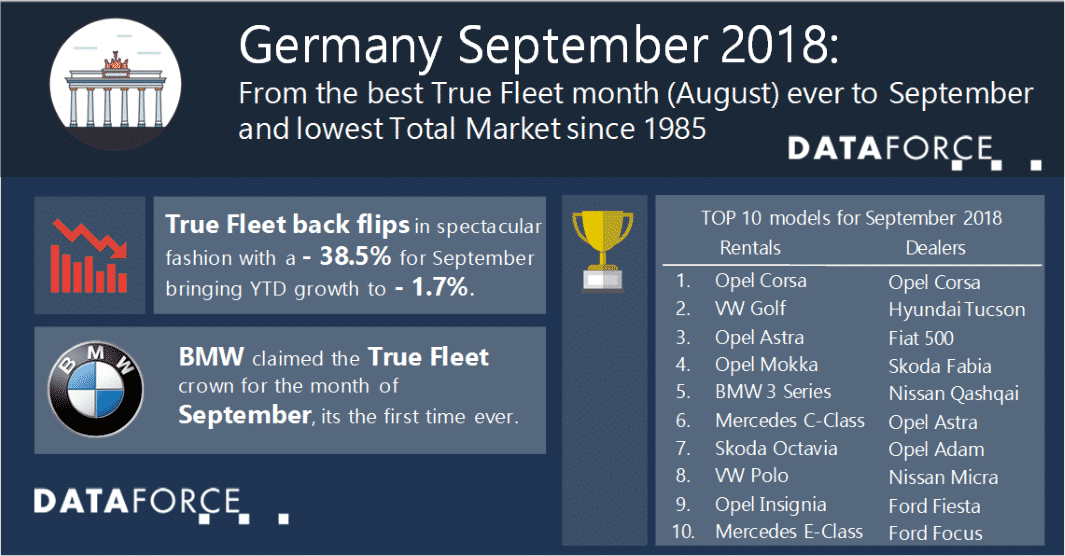

For the True Fleet Market, the percentage decrease was even wider (‑ 38.5%) than for the Total Market but what reassures us was that absolute figures were only the worst in the last nine years. While the Private Market took a similar punch (‑ 33.7%), registrations of Dealerships, Manufacturers and Short-Term Rentals were a little closer to their 2017 comparatives (‑ 22.7%).

Brand performance

In the top 10 ranking for Germany you always find the “usual suspects” with little or no movement – though this was quite the contrary in September. Those OEMs that were able to deliver Euro 6c cars climbed the ladder while others dropped by almost 80%.

For the first time ever, BMW took the crown in the True Fleet Market, delivering a + 1.7% i.e. performing 40.2 percentage points better than the channel. Rank number two went to another premium manufacturer though they could not completely hold up against the WLTP storm. Mercedes just lost less than their competitors. They were followed by VW on number 3 and for the marque from Lower Saxony it was the first month ever (!) they did not claim the True Fleet Market’s pole position.

Positions 4–6 were claimed by Škoda, Ford and Opel who all climbed one step on the ladder. The blue-oval brand may have performed even better. Registrations grew steeply for models such as the Fiesta, Ecosport, C- and S-Max, but it was the Focus that dwindled by 85% which stifled a better result.

Rank number 7 went to Audi, a brand usually seen on the podium while Toyota, Volvo and Peugeot completed the top 10. The Swedish brand missed September 2017 figures by just 18 registrations, an excellent performance in such a pressured market environment.

While only one brand in the top 10 grew against the trend we found a few other marques in the black. A sharp rise in CX-5 fleet registrations boosted Mazda to a + 13.8%, into rank number 11, its best position since august 2006. With a + 3.0% Citroën appeared well prepared for WLTP but it seems they were missing a capital “J” to be part of the month’s high-risers: Jaguar’s registrations surged by 33.9% while Jeep achieved an even higher + 46.1%.