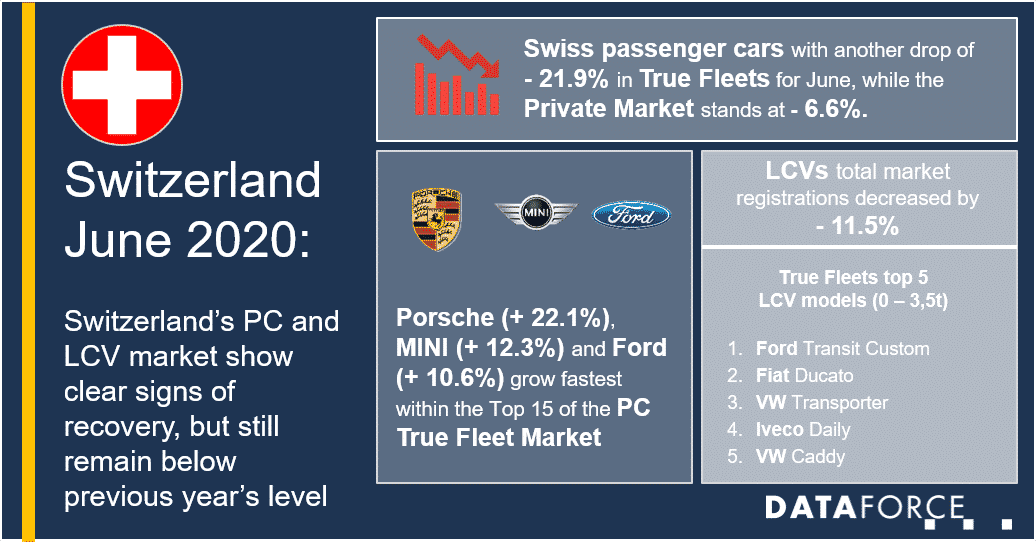

In the context of the post COVID-19 “new normality”, there was a noticeable revival in the Swiss automobile market this June. This ultimately resulted in more than 24,100 registered passenger cars. Despite this significant recovery, the Swiss passenger car market remains 15.2% down on the same month last year. Although registrations of light commercial vehicles up to 3.5t were more stable, they were ultimately also 11.5% below the previous year’s level.

Swiss passenger car market in June 2020

For the first time since the outbreak and resulting consequences of the COVID19 pandemic the Swiss passenger car market showed signs of recovery in June. The Private Market in particular (- 6.6%), with over 13,000 registered passenger cars, came much closer to the level of the same month last year. Commercial registrations (- 23.5%) also rose noticeably compared to the previous months but remained far below normal. After the first six months of the year, the passenger car market in total was more than one-third below the previous year’s level.

Company registrations within the True Fleet Market (- 21.9%) developed slightly better in June than commercial registrations overall. In summary, the highest-volume commercial retail channel (True Fleets), after the first half of the year, was 31.9% down on the same period last year. Within the tactical channels, car rental registrations (- 29.1%) again recorded the sharpest decline. Dealer/Importer registrations in June were 21.1% down on the same month of the previous year.

True Fleet Market: Mercedes jumps to second place in importer ranking

As a result of the general recovery, the winners in the True Fleet market also returned at the importer level. Among the top 15 vehicle importers, Porsche (+ 22.1%), MINI (+ 12.3%) and Ford (+ 10.6%) in particular scored points among Swiss fleet managers. Among the top 5 importers, only Mercedes (+ 3.6%) was able to increase its registrations compared to the same month last year, which helped the brand with the 3 point star to jump to second place in the overall ranking behind Skoda (- 9.3%) and ahead of VW (- 35.9%).

This development was driven in particular by demand for the Mercedes GLE (+ 171.0%), which was the strongest among the top 15 fleet models in June and has been able to build on its positive development since the beginning of the year (+ 198.4%). Within this ranking, the Skoda Karoq

(+ 140.9%), Renault Zoe (+ 74.4%), BMW 3 Series (+ 34.2%), Audi Q3 (+ 15.0%) and Volvo XC60

(+ 2.9%) models also recovered and in some cases quite significantly.

Demand for plug-in hybrids remained strong (+ 408.9%). A curiosity in the past month of June was provided by the Volvo brand, whose XC60, XC40 and XC90 models were the top three fleet models in this category. After the first six months of the year, plug-in hybrids already accounted for 4.5 percent of all fleet vehicles.

Market development of light commercial vehicles up to 3.5t

The upturn in the Swiss automobile market was also reflected in the number of registrations of light commercial vehicles up to 3.5 tonnes. The Private Market managed to increase by 2.3%, while commercial registrations fell by 14.9% compared to the same month last year. Overall, total market registrations after the first half of the year were almost 21% below the previous year’s level.

The True Fleet market again recorded the largest registration volume in this vehicle category but fell by a further 14.5% compared with the same month last year. By contrast, Dealer/Importer registrations fell by only 8.1%, while the car rental channel (- 56.8%) was again the hardest hit.

Within the top 10 importer brands in the True Fleet market, Ford (+ 22.3%) and FIAT (+ 15.7%) managed to improve by double-digits while Citroen (+ 5.4%) and Peugeot (+ 4.7%) were also positive but did not achieve the same expansive growth. After the first half of the year, VW led the fleet ranking with a market share of 23.7%, followed by Ford (15.9%) and Mercedes (11.1%).