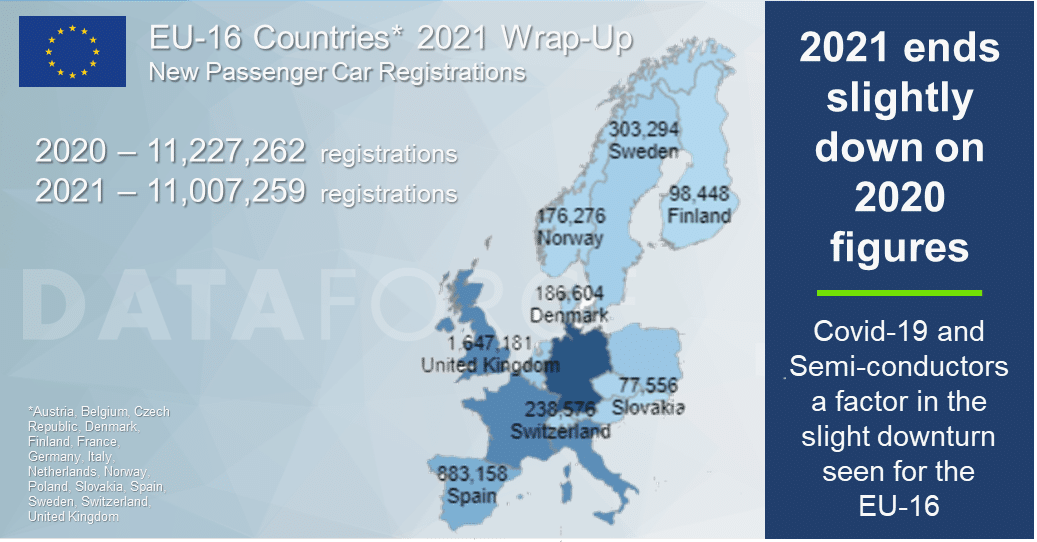

The EU-16 countries of Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Slovakia, Spain, Sweden, Switzerland, and the UK finished 2021 just shy of the 2020 total for passenger cars. Overall, the 11,007,259 registrations were 2% lower than the previous year with COVID and chip shortages the cause for the continued decline. This article examines the positive and negative ups and down plus those that are a question of perspective.

So which “ups” & “downs” were positive?

Well, there is of course the most obvious “up” coming from fuel type. The BEVs, PHEVs and Hybrids all showed record volumes, with the BEVs and PHEVs both exceeding 1,000,000 registrations each in 2021 or + 62.7% and + 67.8% respectively over their 2020 figures. True Fleets increased their PHEV volume by 186,000 units over 2020, but it was a staggering +244,000 for BEVs from Private registrations which saw the largest volume increase of any fuel type and channel.

Positive “downs” come from the CO2 output of the EU-16 countries. With the average emissions being 116 grams based on WLTP, this was an average CO2 reduction of 19 grams over 2020 and shows the positive impact of the alternative fuel type increases and ICE engine decreases. Winner in terms of reductions goes to Norway which dropped its CO2 output by an impressive 40% and putting this into context actually makes this even more staggering! The previous year was already only 47 grams, meaning for 2021 they have managed an output of just 28 grams! Next nearest competitor was Sweden, which also dropped 20% to finish on 90 grams. Other countries to reach the sub 100 grams for 2021 were Denmark with 93 grams and the Netherlands with 95 grams, so it truly is the Scandinavians leading the way.

Which negative “ups” & “downs” did we find in the EU16?

Sticking with CO2 for the EU-16, there is one country which showed an increase over 2020 output, and that was Slovakia. It has moved from 149 grams in 2020 to 160 grams in 2021. Looking at the market channels, we see that the biggest increases came from the tactical channels of RAC and Dealer/Manufacturer which showed increase of 12% and 10% respectively.

Given their status as leading passenger car manufacturer VW showed a slight contraction finishing down by 70,000 registrations or 0.4% market share. However, what should be quickly pointed out is their volumes increases in BEVs and PHEVs over 2020 registrations. A growth by 65,900 units account for a little over 7.7% of all the increases seen in the EU16.