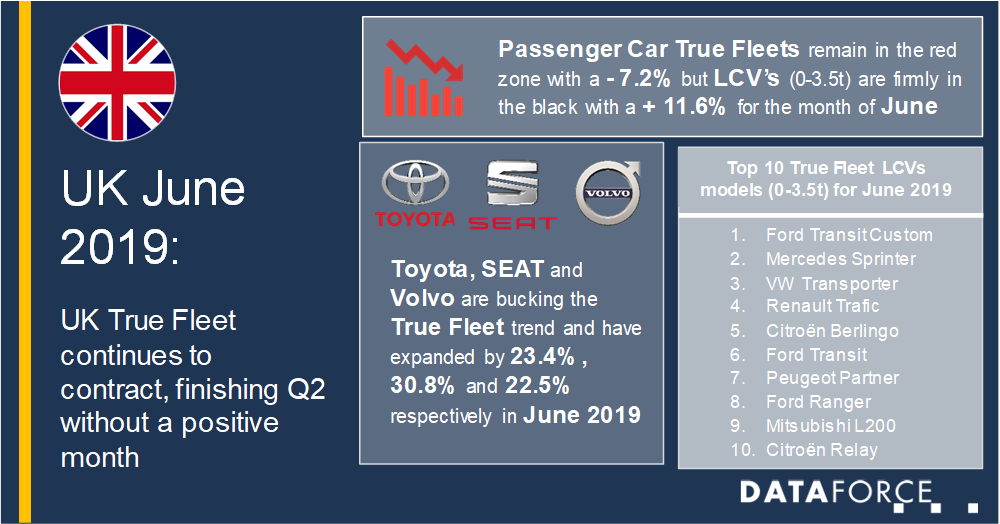

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a – 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a ‑ 4.8% which unsurprisingly then resulted in a positive month for the Dealership/Manufacturer channel with a + 2.6%. RAC was also negative for June but has managed to remain in the black to the tune of 5.0% YTD. In total the UK market finished with 223,000 registrations resulting in a drop of 4.9% when compared to June 2018.

Brand performance

While the market continues to struggle it is certainly not every OEM that is feeling the pinch. Some are positively thriving in the adverse conditions. VW retains the number one spot despite a challenging month while Ford recaptured two places to put itself back into 2nd for June. The blue oval brand saw some great performances from the Fiesta, Ecosport and KA+ helping them to finish with a + 17.8% and marking its first month of growth since August 2018.

Toyota and SEAT took 8th and 9th respectively and both these manufacturers seem to be bucking the overall trend, gaining some great results for not only the month but YTD as well. Toyota registered a + 23.4% for June and a + 8.2% YTD, while SEAT grew by 30.8% and are 11.5% YTD. Toyota has the Yaris, C-HR and the Prius Plus to thank while for SEAT it was their SUV line up of Ateca, Arona and Tarraco.

A generous and worthy mention must go to another OEM just outside the top 10. Volvo in 15th position for June managed to increase by 22.5% but even more impressive is their current result YTD, where they have achieved a + 44.9%. A quick look at the model range clearly identifies the XC40 the star within the Swedish brand YTD but its big brother the XC60 is not to far behind.

The LCV market – Polar opposite to Passenger Car registrations

Bringing some much-needed sunshine to the automotive space in the UK, LCV True Fleets (up to .3.5t) are having a very positive year in 2019. For the month of June there was an increase of 11.6% while YTD figures show the segment up 8.4%.

We see a similar pattern in Switzerland, Latvia and the Czech Republic with the Swiss PC market down by 9.3% while LCV are up by 5.2%, Latvian Passenger Cars down by 6.0% while LCV are riding high with a 15.8% increase and to a lessor extent for the Czechs with a 17.0% contraction in PC but a 2.4% increase on the LCV side.

The clear leader in the UK in regard to brands is Ford with almost double the amount of registrations YTD than its next rival in the standing Mercedes. Mercedes and also Renault (6th) have made significant gains with a +47.7% and 27.0% growth for them respectively thanks largely to the Sprinter and Trafic though this still leaves them a way off from eclipsing the Ford domination.