360° view around the company car driver – what does your end customer think?

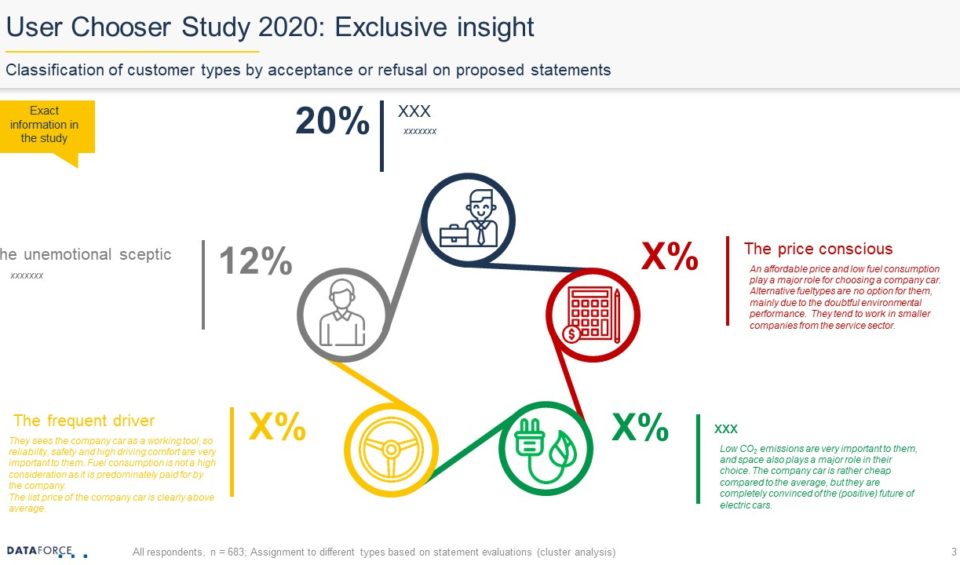

It is finally here: The new edition of the User Chooser Study 2020. With a survey of almost 700 company car drivers, this study provides information about the various criteria that influence the purchase decision of the company car “User Choosers”. Discover what features the company car must have, how they think about alternative drives, what certain business sectors preferences are, plus many more insights. The new study concludes with a detailed characterisation of those user choosers: How exactly do your end customers think and what influences their decisions? – a 360° view of the company car driver.

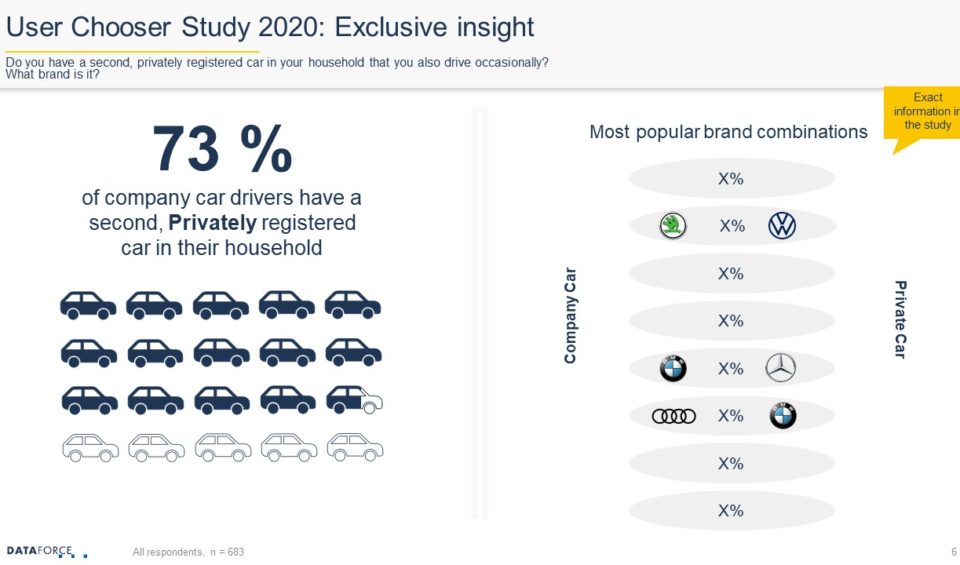

“73% of company car drivers have a second car in their household.”

One topic that has preoccupied the fleet market for longer than Corona is digitalisation. Four years after our last survey of user choosers, Dataforce has once again generated a version for 2020 in a new large-scale edition of the popular study. In this 2020’ version, almost 700 company car drivers were asked about various topics relating to company cars. The result is 80 pages of insight into the buying process, decision criteria, feelings and much more of your direct end customers.

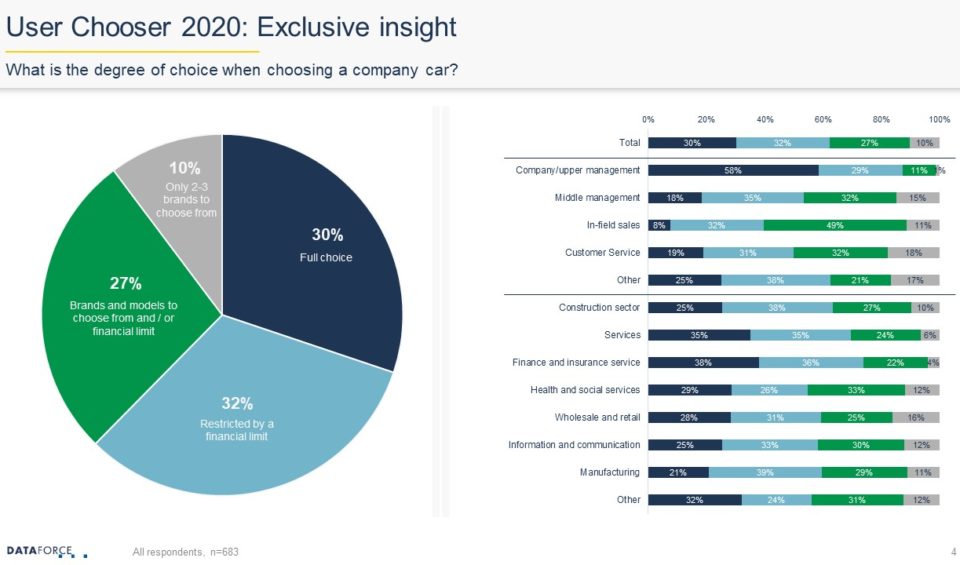

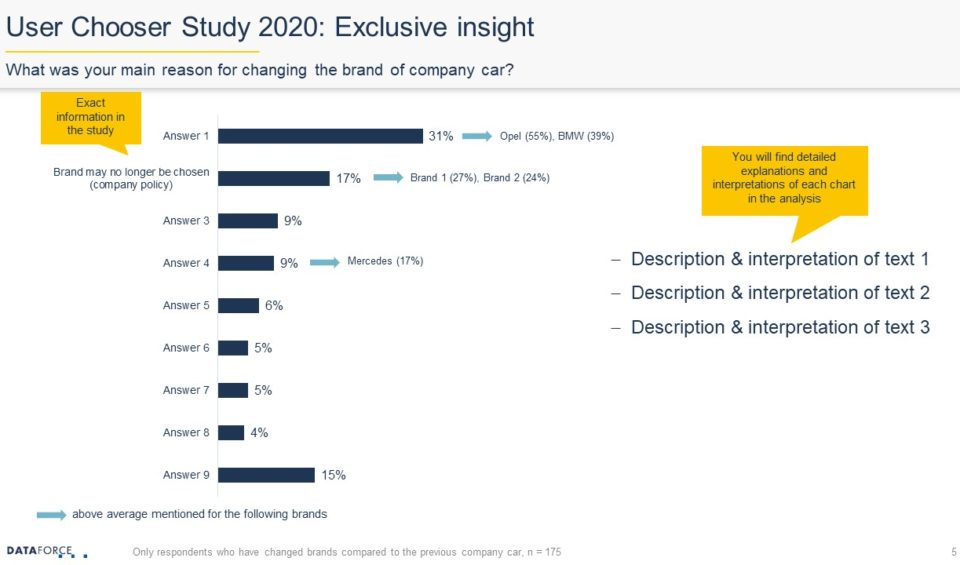

The questions of the study in this edition are designed in such a way that not only are the standard questions clarified, but also, in particular, the motivation of the user chooser was captured. With the extensive range of brands and models available in today’s automobile market, it was important to highlight why company car drivers chose a new model or stayed loyal with the old one. The Dataforce market research department also achieved particularly interesting results in the area of car policy: What are the maximum leasing rates? or are there limited options?

In this study we look to illuminate the user chooser from all angles. You will become aware of where the user choosers get their information, when and where they make their purchase decision and which other factors influence them. In the end there is the answer to the burning question of: Do we still need the “classic” car dealer, or can manufacturers now handle sales via digital showrooms?

Content

- Study design and sources

- Analysis Part I: The User Chooser and how the company car is selected

- Shares and potential

- Sample composition

- User choosers characteristics – the 5 types of user chooser

- Car Policy (specifications and satisfaction of the user chooser)

- Relevance of information sources (before the acquisition)

- Decision criteria (brand, fueltype etc.)

- Analysis Part II: Brand Choice and Loyalty

- Brand’s distribution, fueltypes and gross prices

- Brand and model loyalty

- Analysis Part III: Alternatives – fueltypes

- User Chooser‘s knowledge level: unresolved questions?

- Willingness to change

- Pros and Cons: use as company car

- Management Summary & Recommendations for action