- With 2.65 million passenger car registrations, the year 2022 closes with a slight increase of about 29,000 passenger car registrations or + 1.1 percent compared to the previous year. Encouraging, but still almost 956,000 units short compared to the pre-crisis year 2019.

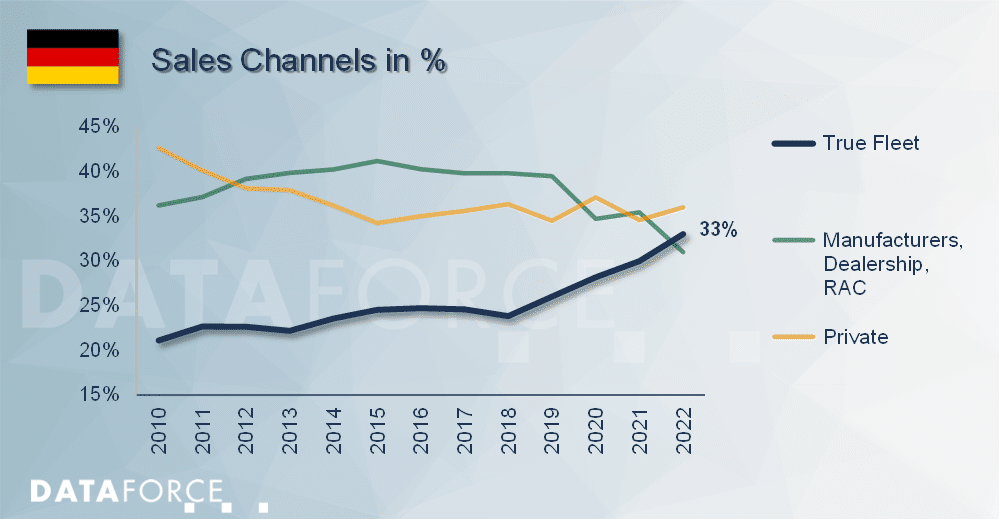

- The relevant fleet market continues to grow in importance with a market share now at 33 percent.

- 36 percent of all newly registered passenger cars in the private or fleet market were either an electric or plug-in hybrid. In the overall market, the rate was 31 percent.

Dataforce Balance Sheet 2022 – A difficult year with a halfway conciliatory end

As the overall passenger car market was always in the red from March, up to and including November compared to the same period of the previous year, it finally turned positive with 1.1 percent thanks to an extremely strong December. This result was duly influenced by the cuts in subsidies for electrified vehicles that will come into force at the beginning of 2023, resulting in significant pull-forward effects, especially in December. Dataforce estimates the volume of this special effect as follows:

Fleet customers are becoming increasingly important

868,000 new registrations in total meant a pleasing increase of 10.5 percent for the corporate customer group compared to 2021 and the second highest annual volume for this channel so far. The importance of fleet customers has thus increased further: every third newly registered passenger car went to a corporate customer last year. This is a new record at the annual level.

With a share of 36 percent, the private market was again ahead, but the gap to the fleet market segment is shrinking. Due to production restrictions at the manufacturers caused by lack of semiconductors, cable harnesses and other preliminary products, the volume of vehicles that could be delivered fell. Priority was given to private households and fleet customers. Accordingly, the share of new passenger car registrations accounted for by car rental companies shrank, and self- registrations by dealers and manufacturers also declined. This was certainly beneficial to the profitability of manufacturers and dealers. At only 31 percent, the share of these so-called special influences was as low as it had last been since 2009, the year of the scrappage scheme, when almost 63 percent of all new registrations took place in the private market.

Brand development in fleet: Availability is the trump card

Given double-digit market growth, there were of course some brands whose volumes increased compared to 2021. Due to the sometimes very tense supply situation, many fleet managers and user choosers were prepared to consider other brands. Noticeable for Hyundai, Kia and Tesla as they were able to increase significantly more than the market and were likely taken into account by fleets that had previously tended to rely on other makes.

The strongest growth in the fleet market in absolute terms was achieved by CUPRA. With almost 23,000 new registrations, the brand placed eighth in the fleet ranking, ahead of established competitors such as Hyundai, Renault and Toyota. Two brands that one might not immediately think of in the fleet business were also able to shine: Fiat achieved an impressive fleet market growth of 84 percent and Dacia, which until now had almost sold exclusively to private customers, also achieved an enormous growth rate of + 69 percent.

Fuel types: significant boost for electric mobility in fleets

As a result of the above-mentioned early purchases, the registration volume of both plug-in hybrids and purely electric passenger cars has grown compared to 2021. In total, these two types of drive achieved a share of 34 percent in 2022 as a whole. BEVs achieved the largest growth in absolute and percentage terms, reaching a share of 16.6 percent in fleets; and the trend is continuing upwards.

Despite growth in 2022, the great age of PHEVs seems to be gradually coming to an end. In proportion, BEVs are becoming more and more important – certainly in fleets.