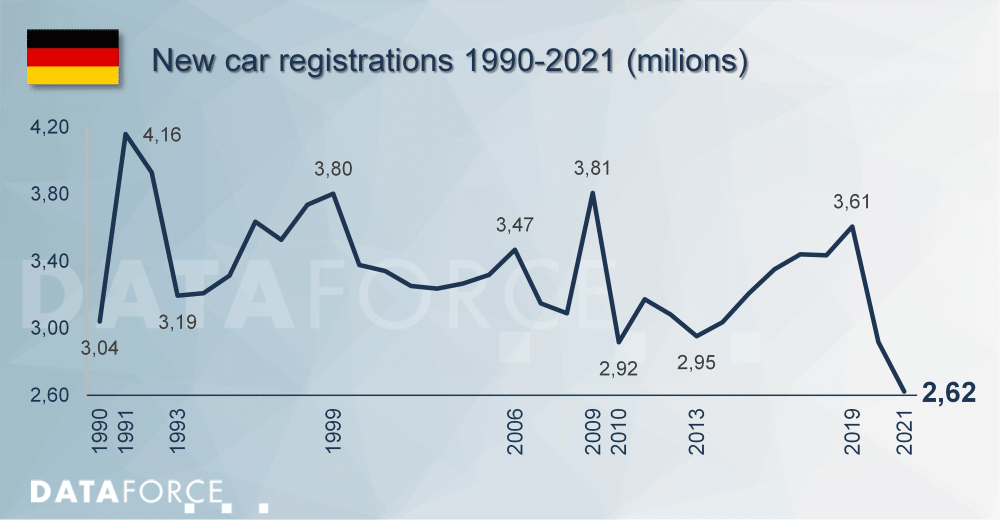

- At 2.62 million passenger car registrations, 2021 closes with -295,546 passenger car registrations compared to the previous year – a historically low figure. Measured against 2019, this is almost one million fewer (-985,126) registrations.

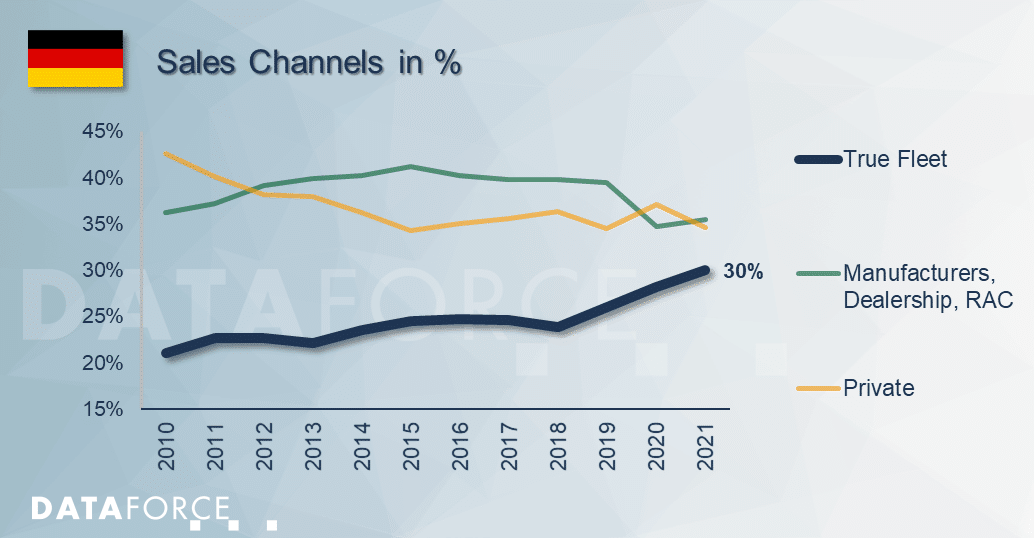

- True Fleet is steadily gaining relevance, with its market share rising to 30%.

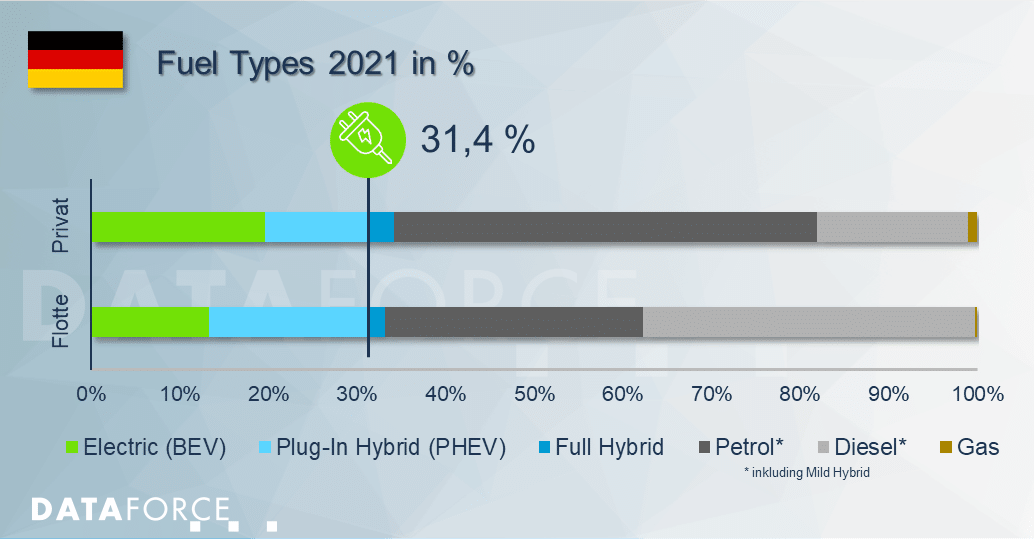

- Almost one in three newly registered passenger cars in the private or fleet market has an electric powertrain (BEV/PHEV).

- Targeted approach by car dealers is the key to success – fleets want concentrated expertise and service

Dataforce Résumé 2021 – A special year with positive prospects

How did the year 2021 close and how should it be assessed in the current context? At 2.62 million new passenger car registrations, the level of registrations is lower than it has ever been since reunification. Within two years, the volume differs by just under one million vehicles.

Fleet customers become more and more important

Looking at the facts, this sounds very serious, but the trends also point to opportunities that need to be recognized in order to take advantage of them. At Dataforce, we take a very close look at the individual market segments whose importance is shifting over time.

For the first time, True Fleet, i.e. new commercial registrations excluding Manufacturers, Dealerships and RAC (Rent-A-Car), has now achieved a share of 30%, which further underlines the focus on this target group.