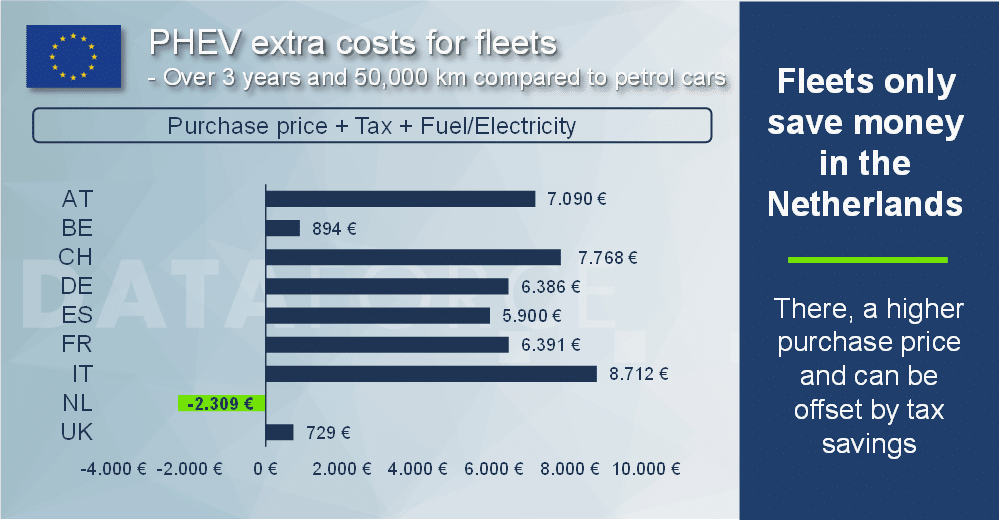

In the past, plug-in hybrids enjoyed purchase grants and significant tax advantages over pure internal combustion cars, which made them particularly interesting for companies. But in the meantime, the incentives have changed in many European countries. Dataforce has taken a closer look at the respective conditions and found out in which countries plug-in hybrids are (still) paying off.

Taxation must not be complicated

In addition to tax benefits and grants on initial registrations, the Dataforce Car Taxation Guide provides an accurate but easy to understand overview of all applicable car taxes in 11 countries.

It also includes precise calculations of the cost advantages and disadvantages between petrol cars, plug-in hybrids and pure electric cars. The question “where is it worth switching to electric” is answered at a glance. In this analysis, Dataforce took a closer look at plug-ins.

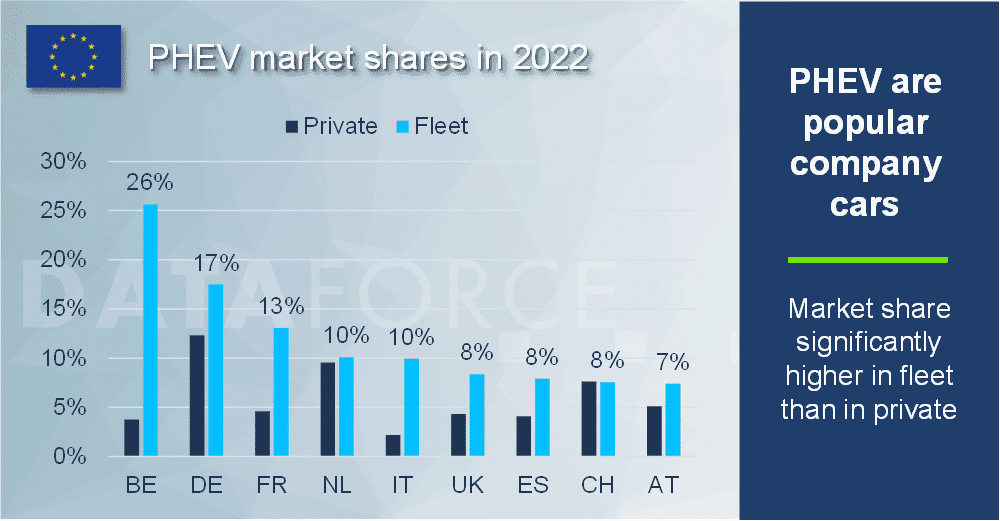

PHEVs in 2022 particularly popular as company cars

Looking at the market shares of PHEVs not only reveals major differences between countries. It is also noticeable that the shares in the fleet market are generally significantly higher than in the private market. There are several reasons for this. On the one hand, the typical company cars in the D and E segments are often equipped with hybrid systems by manufacturers in order to reduce the emissions of the large vehicles.

On the other hand, company car taxation plays an important role. In Germany, for example, the rule still applies that plug-ins as a benefit-in-kind only have to be taxed at a rate reduced by 50%.