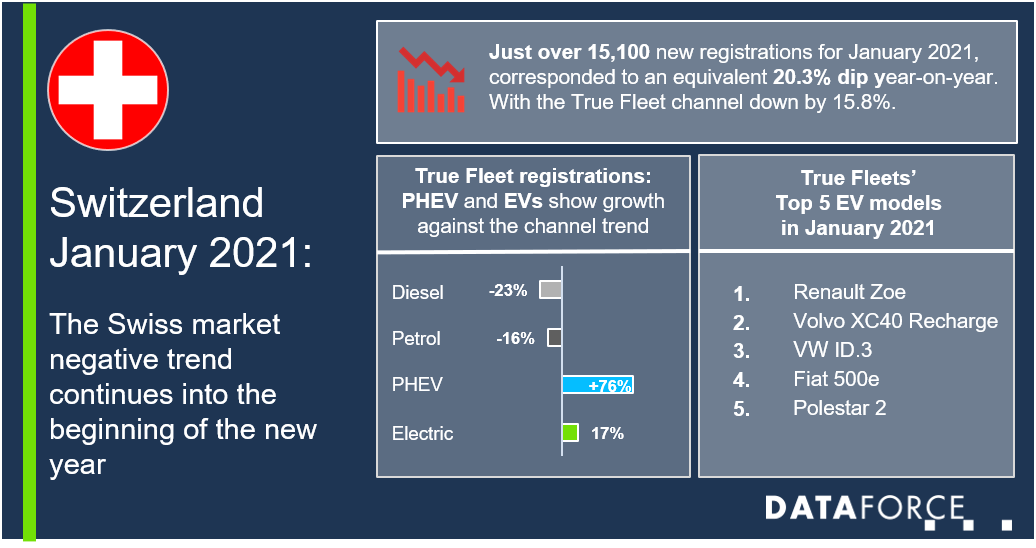

In January, slightly more than 15,100 new passenger cars were registered in Switzerland. After twelve consecutive months of market decline in 2020, the trend continued in the first month of the new year (- 20.1%). The market for light commercial vehicles up to 3.5t also lost ground, however the losses here were visibly limited (- 2.4%).

Swiss passenger car market in January 2021

The renewed tightening of measures to contain the COVID-19 pandemic in Switzerland also resulted in the closure of Swiss showrooms from mid-January. The negative effects on the passenger car market were unmistakable and registrations fell by 20.1% compared to the same period last year. In the wake of this, registrations in the private market fell by 6.0%, while commercial registrations suffered a far greater damper (- 33.3%).

A look at the commercial detail channels showed a decline of 15.8% in the highest-volume segment, True Fleets. In contrast, registrations of Dealers/Importer, which can be classified as tactical, fell by 30.9%, while the registrations of car rental companies slumped almost entirely contracting by 83.8%.

True Fleet market: Citroen, Peugeot and Audi in the green; alternative powertrains in demand

Within the top 15 importers, Citroen (+ 55.6%), Peugeot (+ 48.3%) and Audi (+ 43.4%) were able to increase their fleet registrations the most. Despite significant declines in some cases, the Swiss fleet ranking is led by the German importers BMW (- 27.3%) ahead of VW (- 33.9%) and Mercedes (- 8.1%).

The trend towards Plug-In-Hybrid models (+ 75.5%) and electric vehicles (+ 17.3%) in Switzerland continues. One of the reasons, quite certainly, is the significantly expanding model range. EV-models such as the Volvo’s XC40 Recharge, VW’s ID.3, Fiat’s 500E or even the Polestar 2 were not yet available in January 2020. However, they were among the most sought-after ev-fleet models in January 2021. Electric vehicles were particularly popular in fleets from the cantons of Zurich and Bern, with these regions accounting for almost 40% of all electric fleet vehicles registrations in Switzerland.

Market development of light commercial vehicles up to 3.5t

The market for light commercial vehicles up to 3.5 tonnes presented itself in January with comparatively small losses, almost retaining the previous year’s level (- 2.4%). After a successful 2020, the private market continued its good performance in January and increased by 12.0% compared to the same month last year. Within the commercial detail channels registrations of Dealers/Importer increased by 11.9% and those of car rental companies by 70.0%, though at very low registration levels. And why did the LCV market soften anyway? It was the True Fleet market (- 7.5%) that had clouded the overall picture.

In the first month of the year, the fleet ranking was led by VW (- 22.4%), Ford (+ 15.4%) and Renault (+ 34.4%). Within the top 10 fleet models, the Renault Master (+ 63.6%), the Mercedes Vito (+ 52.9%) and the VW Crafter (+ 45.8%) in particular attracted increased interest from Swiss fleet managers and increased their registrations most significantly.