There is no doubt that COVID-19 has affected the EU5 automotive marketplace in 2020. Delivering both negative and positive results and firsts for the industry but has the Covid-19 pandemic just advanced established trends or help shift the automotive paradigm to new way? Dataforce has analysed 2020 full year registrations to give the end of year result for the EU5.

2020 results by market segments

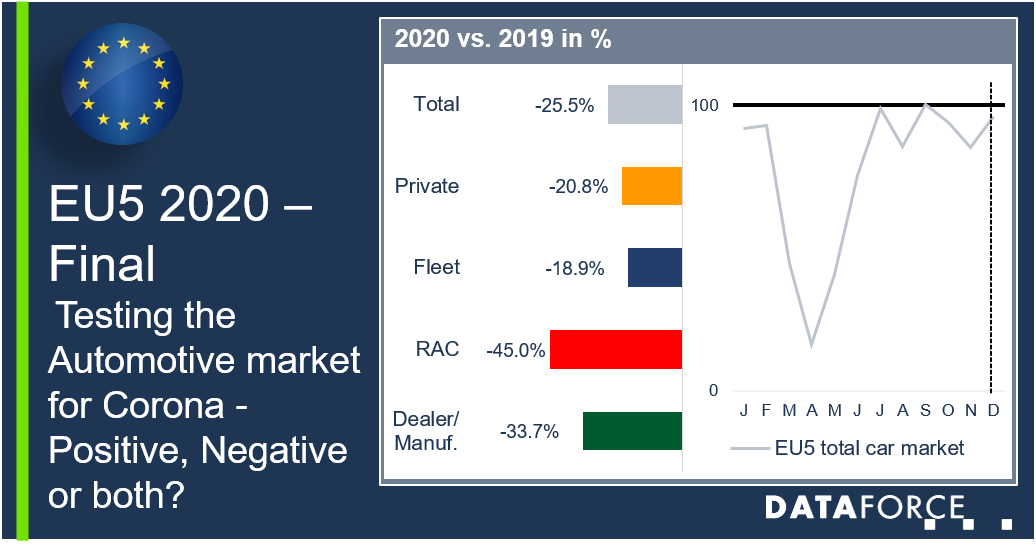

The EU5 finished with a loss of around 25.5% just shy of our predicted 26% for the total passenger car market with none of the market segments bypassing the downward trend. Most heavily effected was the RAC or Short-term Rental market, and understandable so giving the restrictions on both business and leisure travel. This channel finished with the original forecasted 45% loss, though hopes are high that by end of Q1 and for Q2 that we see monthly registrations reach six figures bringing them somewhat nearer previous years volumes.

The least effected of the four main channels was True Fleets contracting by 18.9% thanks to a welcomed surge in December (+ 5.5%) and finishing slightly better than our – 20% prediction. We are certainly of the belief that the lifecycle of the company car/leasing channel cars have mostly kept to the schedule, though some businesses are likely to have extended and the uptake of new contracts would not have been insulated from the overall market effect.

The Private market ended down 20.8% just shy of our 21% forecast, this channel like True Fleets also had a good finish to 2020 with December registrations up by 6.2%. The end of year results were certainly better than either the RAC or Dealer & Manufacturers registrations in terms of percentage loss but the seven figure loss in registrations are likely to have been the biggest blow to OEMs bottom lines.

Dealer & Manufacturer’s registrations ended 2020 with a loss of 33.7% over 2019 final registration numbers. Due to the tactical nature of the majority of these registrations this could be seen as slight positive. Though given that both this and the RAC channel feed the young used car markets this loss may play out in the used car markets during 2021 with vehicles becoming harder to find. It will certainly be interesting to watch the Dealer & Manufacturer channel and see just how the OEMs utilise this turn of events.

2020 a year of Contraction and Capitalisation – Powering Brands

It is unlikely that any manufacturer could have envisaged the upcoming problems that Corona would inflict on the markets at the start of last year. However it is true that both BEVs and PHEVs have boomed during the crisis and manufacturers with these powertrains (including standard Hybrid) have fared better than those without. Plenty of markets increased or placed favourable schemes for the registration of these cars but the question has been without the lockdowns would the boom have been even bigger?

BEVs finished 2020 up by a super 179.8% thanks to a ‘December’ that ended with 98,000 registrations, blowing the record from September 2020 out of the water by almost 40,000 registrations! PHEVs rose by a staggering 265.3% and just like BEVs achieved a record month with over 20,000 more registrations than seen in previous month which was also a record. These registration increases would have helped most manufacturers that had these powertrain models to cushion the blow brought on by the pandemic. Brands with significant positive numbers overall for 2020 are few and far between but EV-only manufacturers Tesla and Polestar and mixed powertrain OEMs MG and Cupra should all finished with positive numbers; however, all the rest have contracted by varying degrees.

Brand power

Looking deeper into the numbers and higher volume manufactures it is quite clear to see the impact the alternative fuel powertrains have in helping ride out the downturn. Toyota and Lexus hybrid powertrains managed to limit the contraction over 2019 to 14.3% and 15.6% respectively. Both DS and Volvo also faired reasonably well shrinking their 2019 totals by 15.3% and 16.2%. Skoda also had a little to be happy about, finishing down by just 15.6% their 2020 releases of both BEV & PHEV powertrains could not have come a better time. In their first year these powertrains combined managed a massive 17,000 registrations for Czech manufacturer and we expect to see a pretty steller 2021 also.

We also saw that both Kia and Volvo have been helped along by the electrification of their model line-ups. Heavy impacts on both manufacturers Petrol and Diesel registrations have resulted in the spotlight coming to bare on their PHEV, BEV & Hybrid (for Kia) and Mild-Hybrid powertrains. Kia managed some 82,000 registrations from these powertrains while for Volvo this was super respectable 69,000 registrations.

Whether or not the Pandemic accelerated or just brough it even more into focus, the electrification of model line-ups for OEMs is likely to formulate an ever-increasing amount of their total registrations. This trend is solely based on the 2021 CO2 targets required, though it certainly gave some direction and push, but governments, businesses, private consumers are embracing the technology and its benefits. It also appears that those manufacturers who move quickest (at bringing these powertrains into play) will reap the biggest rewards and the hallowed market share.

Decentralisation leads to increasing lcv demand

The second half of the year points to two segments that experienced tailwinds from the crisis and this is an opportunity for dealerships and rental companies to compensate for some of their losses. The first trend is the refocussing in logistics. The boom of home delivery can only be met with a decentralised logistics that requires many LCVs instead of a few HCVs transports.

Admittedly, the LCV market took a toll as well ending 2020 down 17.3%, but when considering only registrations between June and December, i.e. since most fall scale lockdowns ended, we already saw a 0.7% increase. Even countries such as Italy and the UK where the passenger car markets recorded the highest losses there was growth in LCVs for the final 7 months. Italy saw a 2.4% increase for June-December while the UK was a slightly more sedate 1.7%. Worth noting was a growing share of these registered on rental companies, possibly due to the increase demand for last mile deliveries as a result of the pandemic.

2020 cars – more frequently used and even more “Used”

The second opportunity is the raise in individual mobility. (E-)Bike demand was so high that some models had delivery times that before were only seen for cars. And when it comes to longer distances or faster travelling then the car is on vogue again. People have spent their holidays in their countries and got there by car, many of them resorted to rental vehicles. The same is true for daily trips. Car sharing and at rental bookings exceeded pre-crisis levels in some of the larger cities.

Those individuals who need to commute on a daily basis once again seek to own a car and given the economic uncertainties, many of them have turned to the used car market. As result residuals have been on the rise all over Europe, which is quite unusual in the middle of a recession.

A closer look at German used car figures confirms this trend. Following a loss of 282,000 registrations in April (-44%) and still a double-digit loss of 14% in May, the situation improved with a growth in all the remaining seven months of the year. This helped the market to reduce the gap for the full year 2020 to only 2.4% compared to 2019. With 7.02 million the level of used cars last year was similar to 2013 and 2014 and not too far behind 2018/2019. This is remarkable as the volume of registrations on dealerships and manufacturer – usually an important source for (young) used cars – was the lowest since 2009 which was the year of a massive scrappage scheme in Germany.