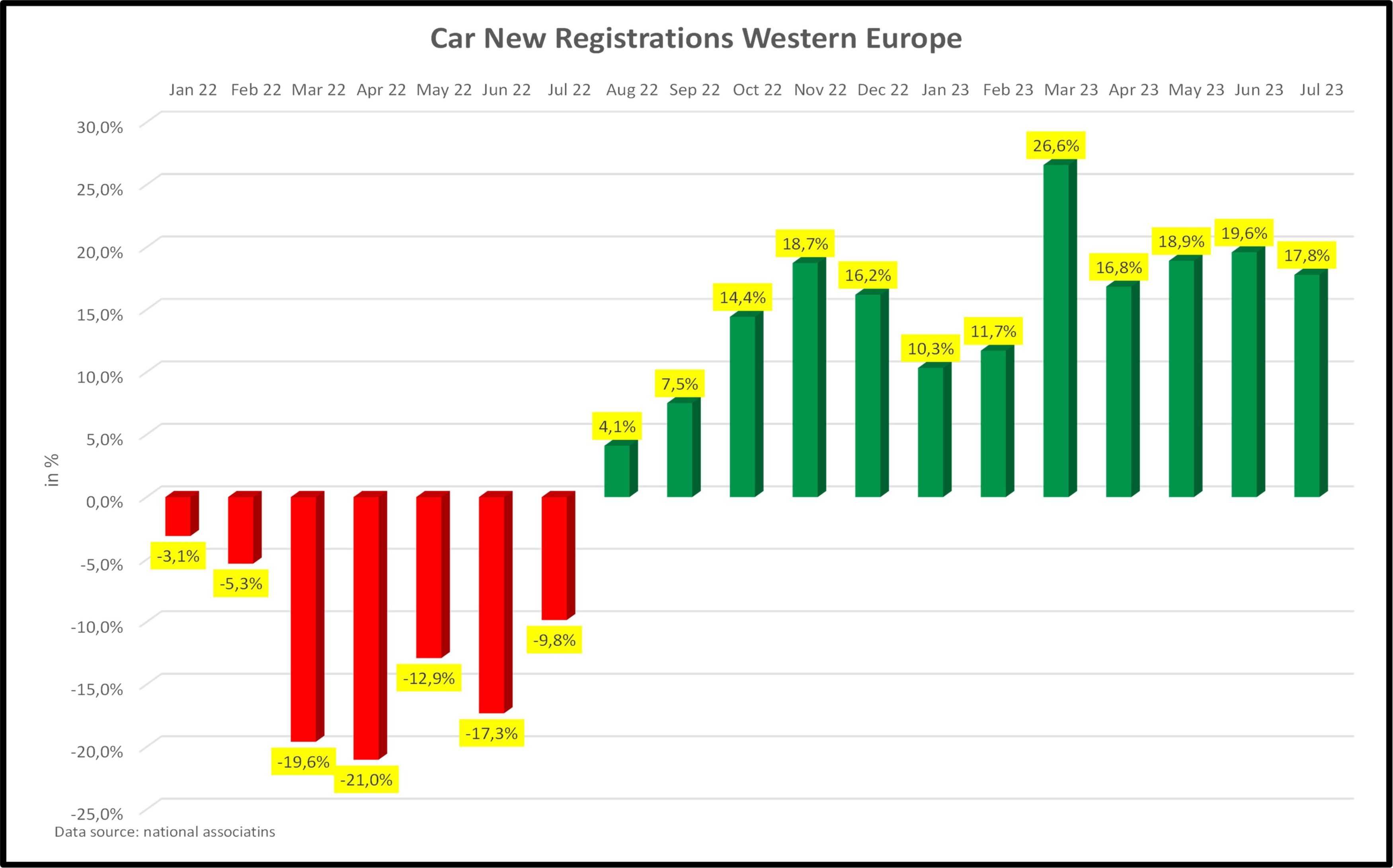

The EU’s new-car market experienced significant growth in July, continuing the positive trend observed over the past 11 months. However, it should be noted that the figures for 2023 are being compared to the months of the previous year when manufacturers experienced delays in deliveries due to parts shortages. These vehicles were partially delivered from the second half of last year, resulting in a disproportionately high increase in new registrations from August 2022. Therefore, it is expected that the growth rates of new registrations will weaken in the second half of the year due to this factor.

Market Update Western Europe August 2023

Frankfurt, 07.08.23

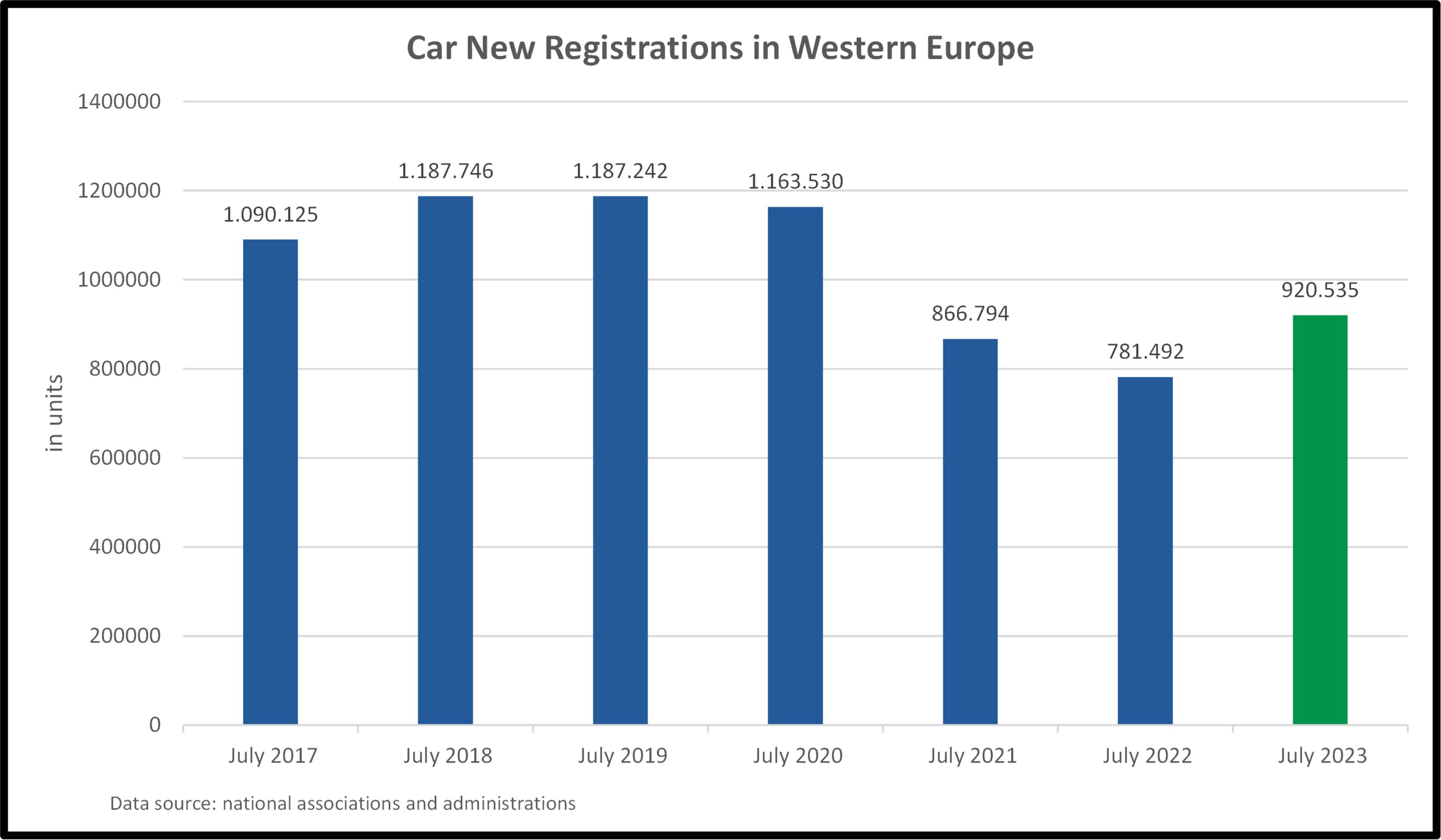

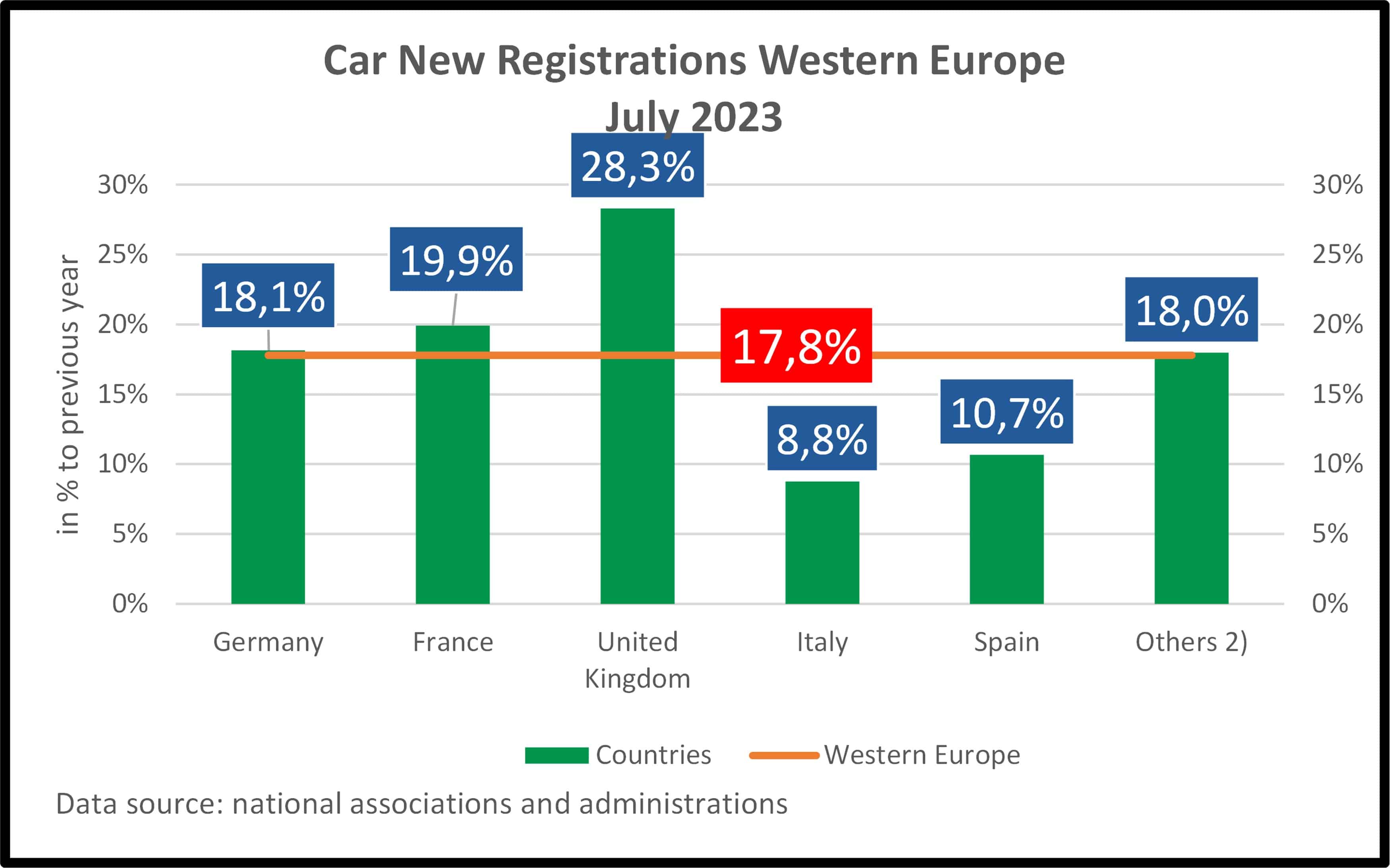

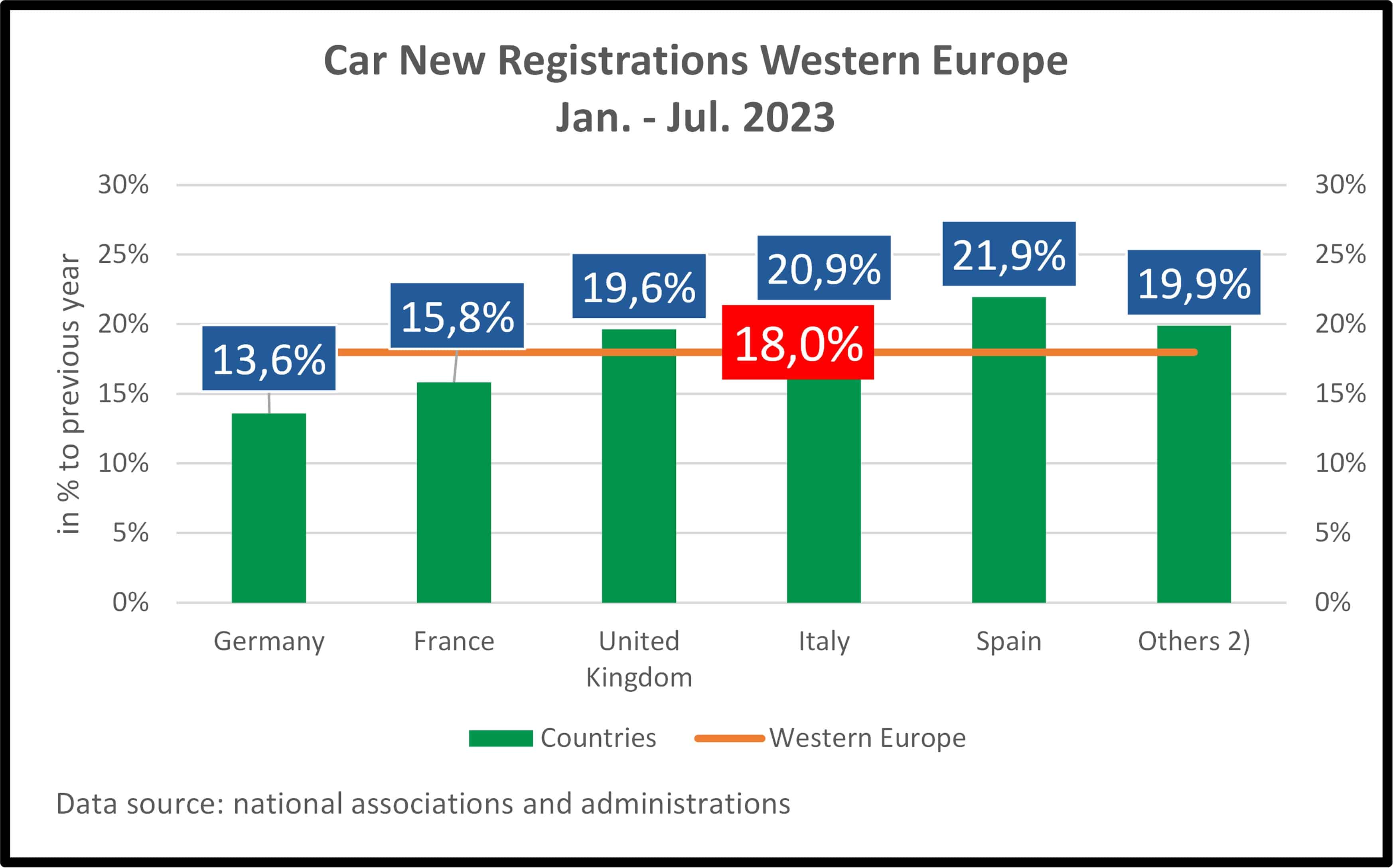

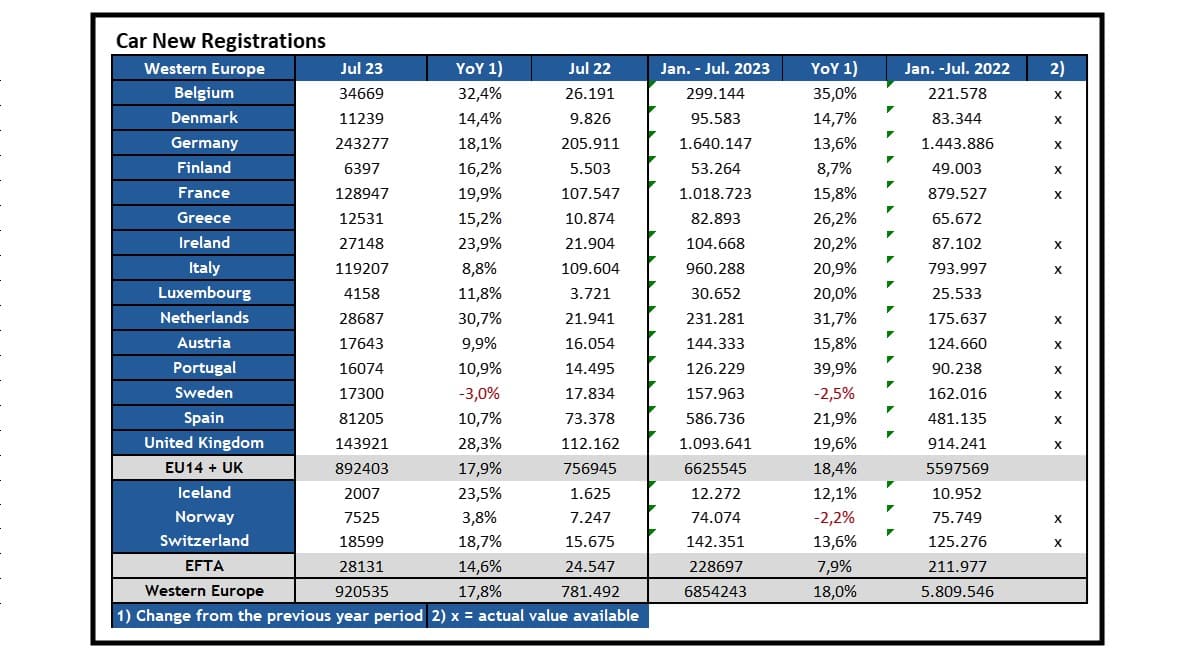

In July, new car registrations in the major European countries were significantly higher than the corresponding figures of the previous year. The new registration figures for the first seven months also surpass those of the previous year.

Strong growth can be seen for BEVs in all markets. The strongest growth of BEV new registrations in the BIG 5 markets could be seen in the UK with about 88% followed by Germany and Spain with 69% and 64%. Growth of PHEV new registrations are also positive with the exception of Germany, where the demand for PHEs has further drastically fallen by almost -40% in July.

In Western Europe, we can expect a mere economic growth of 0.8 percent this year, alongside a persistently high inflation rate of nearly 6 percent.

The reasons for this unfavorable economic situation include the ongoing political uncertainty (such as the Ukraine conflict), high energy price pressures, erosion of purchasing power among households, a weaker external economic environment, strained trade relations with China, more restrictive financing conditions, and the economic consequences of the COVID-19 pandemic.

Forecast 2024

Economic growth will turn positive again as energy prices decrease, foreign demand increases, supply bottlenecks are resolved, and uncertainty diminishes.

The strong labor market will lead to higher real incomes, and unemployment will decline to historically low levels.

The improved delivery capability of manufacturers and the resulting reduction in high order backlogs have led to a significant increase in new car registrations in recent months, overshadowing the declining demand due to significant increases in energy and living costs. However, this effect is expected to diminish in the coming months, leading to lower new car registration numbers.

It is only towards the end of the year that an increase in new car registrations in Western Europe is expected again. Major reasons: a declining inflation rate and an improvement in real disposable income.

Overall, new car registrations in Western Europe are projected to increase by 10.2% to 11,2 million vehicles this year.

Publication only with indication of source (Dataforce).

The company DATAFORCE - Wir zählen Autos

As a leading market research company, we bring transparency to the European automotive market. Independent - with over 25 years of experience - we set standards and make markets comparable.

Contact: Benjamin Kibies

Phone: +49 69 95930-232

Fax: +49 69 95930-549

E-mail: benjamin.kibies@dataforce.de

www.dataforce.de